Retirement overview

Retirement planning tools

Withdrawal and retirement income

Retirement checklists

Your retirement and PensionBee

Retirement article insights

Talk to an expert

Withdrawal and retirement income

Having spent your life saving for retirement, it’s important to understand the different ways you can use your pension as retirement income. You can start taking your pension before you retire from the age of 55 (rising to 57 from 2028). Discover your withdrawal options and how you can combine them for flexibility and security.

Drawdown

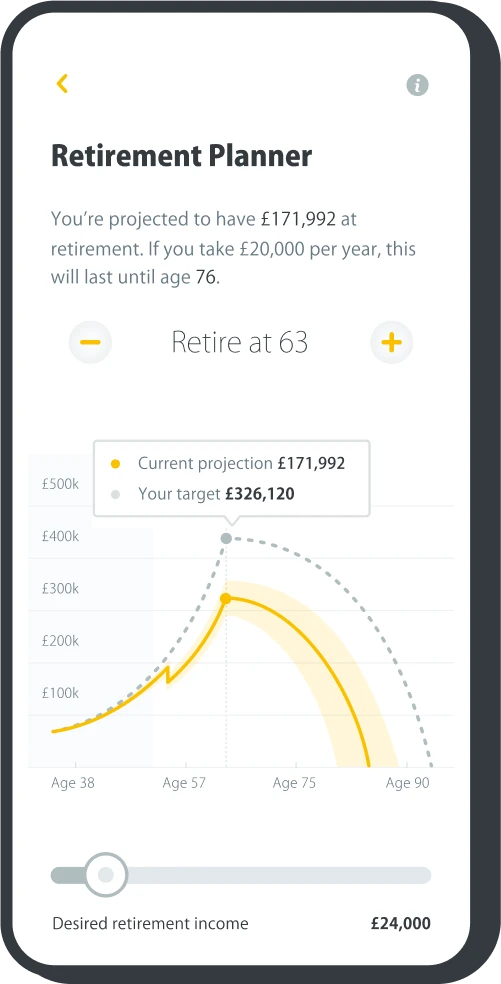

Pension drawdown offers a flexible way to take your pension in retirement. You can take up to 25% of your pension pot tax-free and leave the rest invested.

When you leave your pension invested it may benefit from investment growth, although it could also go down in value. While you can always withdraw money from it as and when you choose, in downturns you may want to consider reducing the amount you withdraw.

Pension Drawdown Calculator

Annuities

When you come to retire you can use some or all of your pension to buy an annuity. An annuity pays you a guaranteed regular income, typically monthly, for either a fixed period or the rest of your life. Generally, the older you are the better the pension annuity rates available. You won’t be able to change your mind once you’ve purchased an annuity, so it’s important to consider which annuity is best for your needs.

With a variety of annuities available, such as enhanced annuities - which typically pay out more if you have a health-related issue which may reduce your life expectancy - and lifetime annuities which pay a regular income for the rest of your life, our guide to annuities explains the different types available to help you decide which may be right for you.

Learn more about an annuity with Legal & General.

Combining withdrawal options

Taking your pension as retirement income doesn’t mean having to choose just one option, you can also combine the various options together.

So, you could use part of your pension to purchase an annuity and leave the rest invested to draw down from as and when you choose. This way you combine the predictability of an annuity with the flexibility of drawdown.

Alternatively, you could take a portion of your pension pot as a lump sum. You could use that lump sum to pay off some debt, make some home improvements or book a trip to celebrate your retirement. You could then leave the rest of your pension invested to draw down from as you choose.

The State Pension

The State Pension is a regular payment you can get from the government once you reach the State Pension age. Although you can access a personal pension, like the one with PensionBee, from the age of 55 (rising to 57 from 2028), you won’t start receiving the State Pension until around a decade later.

Currently, both men and women can claim their State Pension from the age of 66. However, this is set to increase to 67 from 2028. The full State Pension is currently worth £230.25 per week (2025/26), totalling £11,973 per year. These figures are based on current legislation which could change in the future.

Our guide to the State Pension explains more about how to qualify for it, and how much you may be entitled to.