Your investment is at risk. Past performance is no guarantee of future results.

Not bank guaranteed. Not FDIC insured.

Information provided directly by PensionBee or on PensionBee’s behalf, whether via direct communications from PensionBee, publicly accessible pages of PensionBee.com/us (including when accessed via the PensionBee app), PensionBee advertising and sponsorships, PensionBee’s direct and sponsored social media, or otherwise, in each case including any associated customer testimonial or third party endorsement and any information prepared by any unaffiliated third party or link to any third party source (collectively, “PensionBee Materials”) is provided solely for informational and educational purposes.

PensionBee Materials do not constitute tax, legal, financial or investment advice or an offer, solicitation or recommendation to buy or sell any securities or investments.

PensionBee Materials do not consider any individual investors’ specific financial, legal or tax situation, objectives, risk tolerance, or investment needs.

PensionBee Inc. does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of, and takes no responsibility for, any PensionBee Materials.

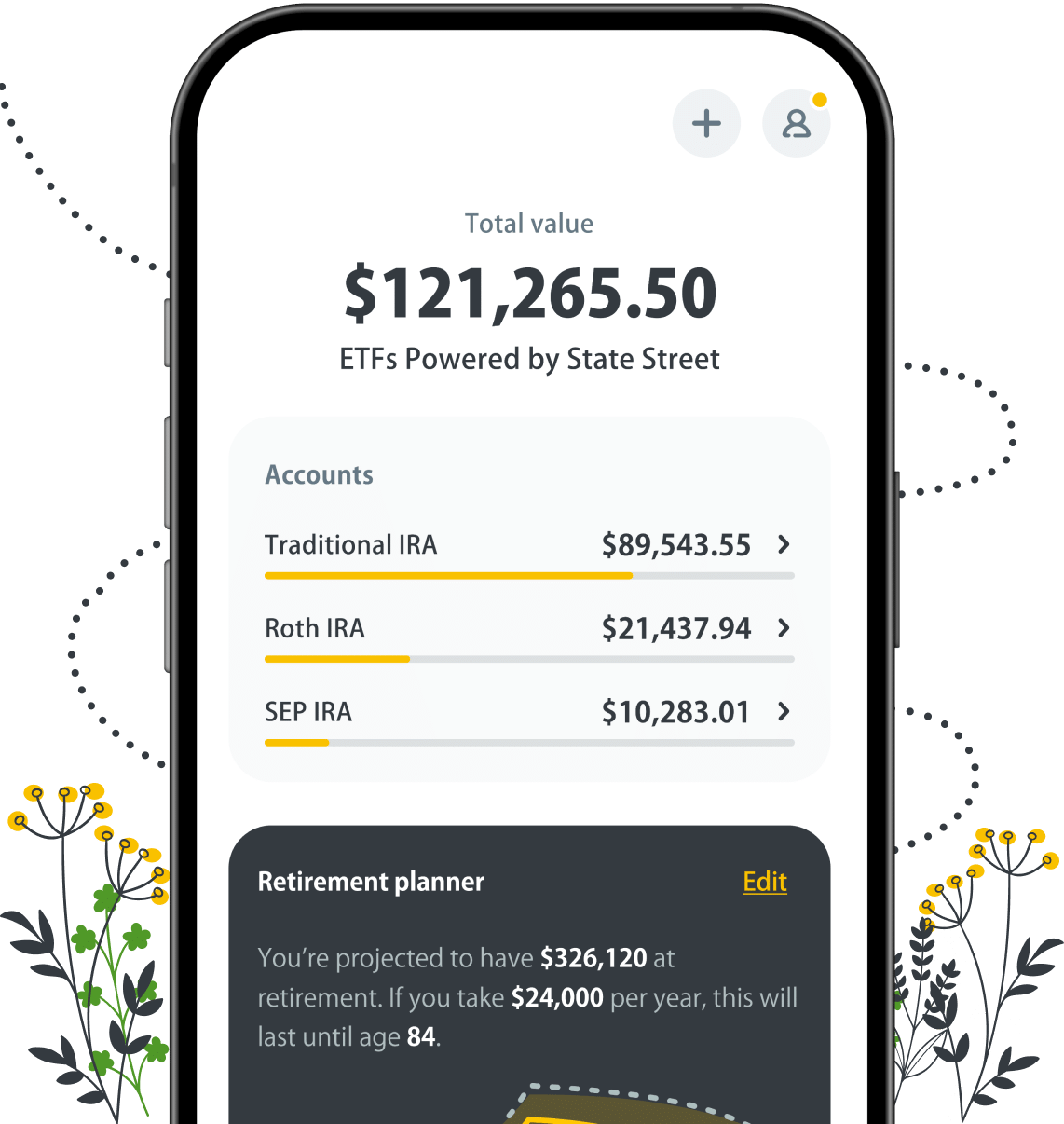

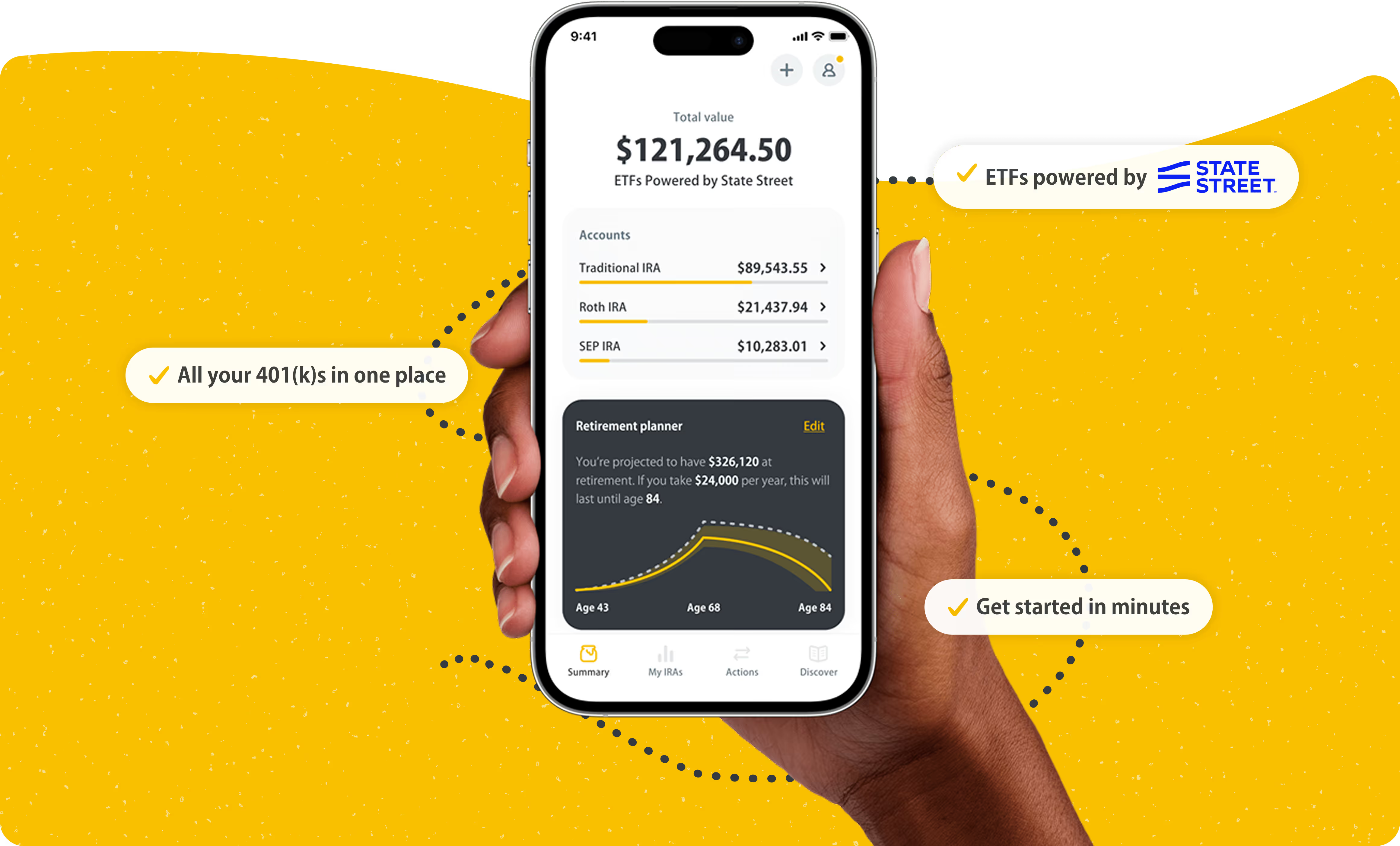

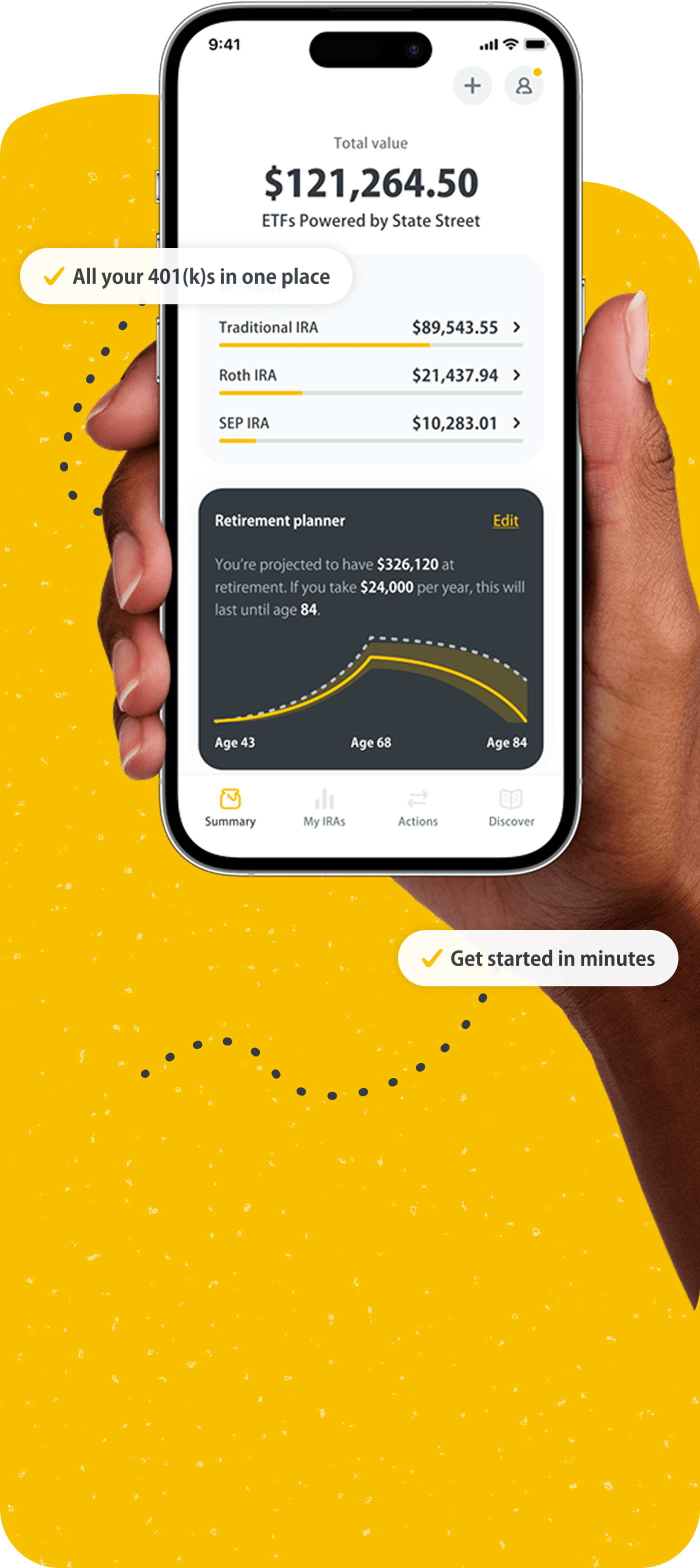

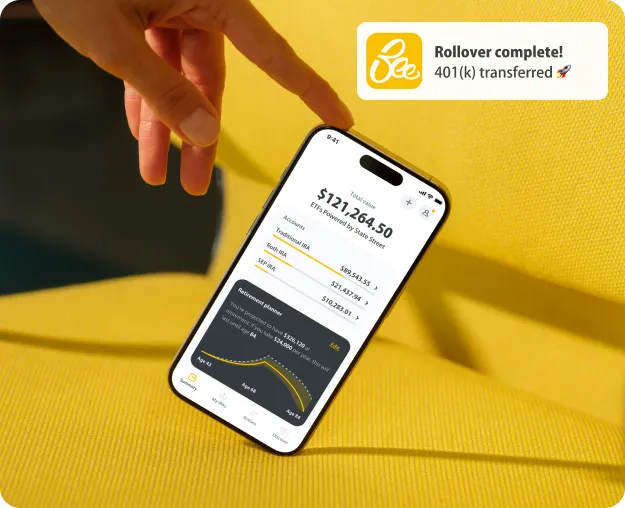

*Product images, figures, and projections used are hypothetical, for marketing purposes only, and do not represent actual customer returns.

1 - This PensionBee customer received a one time cash payment for their testimonial.

Options on Rollovers

A rollover is not your only option for an old 401(k) or IRA, you may alternatively decide to leave your assets with your former employer, rollover your plan to a new employer or to cash in your old plan with the resulting tax penalties applied. PensionBee Inc. does not provide tax advice or individual recommendations as to which of these options is most appropriate for your individual circumstances. To understand the implications of each of the options available to you and help you decide between them you may wish to consult a tax professional who has knowledge of your individual circumstances. For more information see FINRA - Retirement Accounts.

Our collaboration with State Street

State Street is not involved in the management of the strategies and accounts offered to you by PensionBee. State Street and its affiliates are not your investment adviser and are not a fiduciary with respect to you or your account. PensionBee is independent of State Street. State Street is not recommending or endorsing PensionBee or making a determination of the suitability or appropriateness for any individual products or investment strategies offered by PensionBee, including those described herein. Standard & Poor's®, S&P® and SPDR® are registered trademarks of Standard and Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones or S&P, their respective affiliates and third party licensors and none of such parties make any representations regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions or interruptions or any index.

The SPDR® S&P500 ETF®, SPDR® S&P MIDCAP 400® ETF, SPDR® Dow Jones Industrial Average ETF are exchange traded funds with the investment objective to correspond to the price and yield performance of the S&P 500® Index, S&P®MidCap 400®IndexTM and Dow Jones Industrial AverageSM. The shares of the SPDR® S&P 500® ETF, S&P MIDCAP 400® ETF, SPDR® Dow Jones® Industrial Average ETF represent individual ownership interest in the Trust’s portfolio.

Website Cookies

Our website stores data such as cookies to enable our website to function and for the purposes of analytics and marketing. You can disable cookies in your browser by following these instructions. To opt-out of how we use your data see our Privacy Policy. Otherwise, by continuing to use this website you are agreeing to this.

Trust Pilot Scores

Trustpilot is a consumer review platform. Trustpilot scores shown in PensionBee Materials are a result of reviews collected from PensionBee customers in the UK between 2016 and 2025 scoring PensionBee’s UK pension products. Customers were not compensated to give a review. The score has always been 4.5 or higher.

SEC Registration

PensionBee Inc. is registered with the SEC as an investment adviser (CRD # 331741/SEC#: 801-130697). A copy of [PensionBee Inc.'s Brochure] containing our written disclosure statement discussing our business operations, services, and fees, is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from [us].

PensionBee Inc. (Delaware Registration Number SR20241105406) is located on 85 Broad Street, New York, NY 10004.

© Copyright 2025 PensionBee Inc. All rights reserved.

.webp)

.gif)