London, 19 August : PensionBee, a leading online pension provider, has seen a 37% increase in the number of customers who completed their first pension transfer between March and July in , compared to the same period in 2019, signalling that consumers used their time in lockdown to manage their finances and plan ahead for their future.

PensionBee customers were found to have been increasingly engaged with their savings during lockdown, with almost 49,000 customers contacting PensionBee via live chat or email between 1 March and 31 July , up 2% from the same period in 2019. This is more than double the _years_before_7% growth of customers with a live balance.

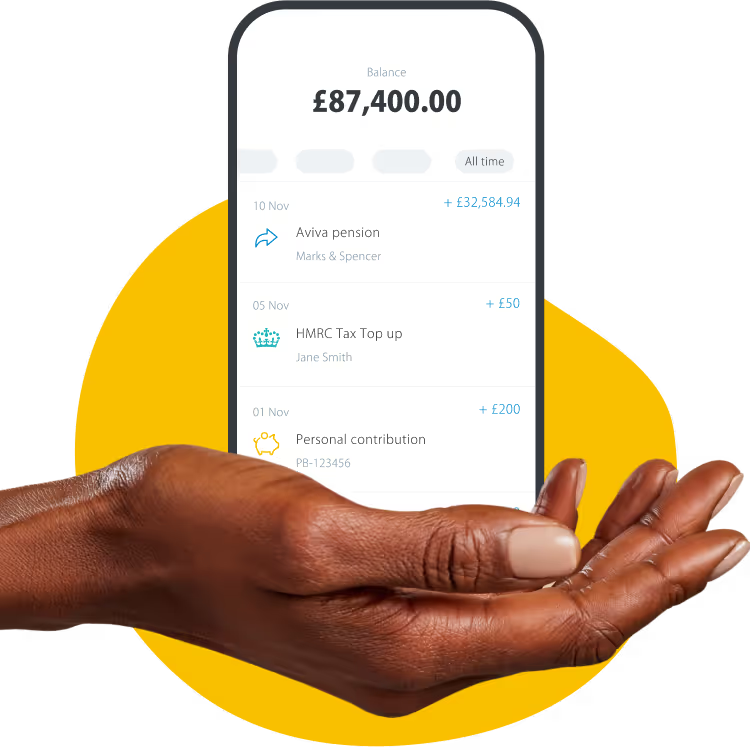

Consumers who manage their pensions online were able to more easily engage with their pensions during lockdown. Between 1 March and 31 July there were almost 400,000 visitors to the online PensionBee balance API through its Open Banking partners, such as Starling, Moneyhub, Yolt, Emma and MoneyDashboard. The pension provider saw a % growth in visitors and an average of c.2,600 visitors a day. In addition, during lockdown PensionBee recorded close to a million customer smartphone app sessions, and almost 40,000 new app installations.

Romi Savova, Chief Executive of PensionBee, commented: “It is encouraging to see that consumers were using their time in lockdown as an opportunity to review their finances and look for ways to further their money. It is during times like this that the benefits of being online are clear - those who manage their pensions with us can more easily check their balance and make contributions than with older, legacy providers. At PensionBee our aim is always to make saving simple for our customers. We work hard to give back control to the consumer – and we urge the rest of the industry to do the same.”

Appendix

Table 1: Growth in number of customers who completed their first transfer

Source: PensionBee, August .

Table 2: Number of times customers contacted PensionBee via live chat and email

Source: PensionBee, August .

Table 3: API calls from third party apps,

Source: PensionBee, August .

Table 4: App engagement, 1 March- 31 July

Source: PensionBee, August .