New analysis conducted by the Centre for Economics and Business Research, on behalf of PensionBee ahead of National Pension Tracing Day, reveals that nearly one in five (19%) UK adults feel certain they have lost or probably lost a pension pot, equating to approximately 8.8 million individuals.

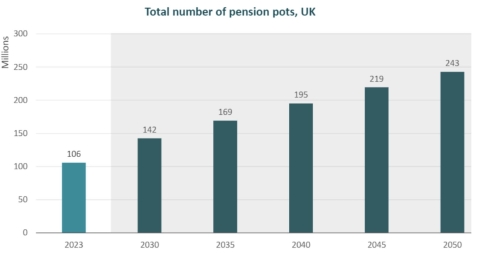

As the total number of UK pension pots is expected to rise 130%, from 106 million (at present) to 243 million by 2050, the number of lost pensions could skyrocket. This is due to more frequent job switching among younger workers and as a result of auto-enrolment, which has significantly increased workplace participation since its introduction in 2012.

A survey of approximately 2,000 UK adults found that preventing lost pension pots (17%) was a key motivator for pension consolidation. However, this was a less frequently recognised benefit than potential cost savings (24%) and easier management (30%).

Only one in five savers (20%) noted they would not be motivated to consolidate their pensions. Notably, older workers were much more likely (39%) than mid-career (12%) or younger workers (6%) to express no motivation to consolidate. Younger workers were much more likely (22%) to be motivated by more flexibility in managing their pension when entering retirement, as opposed to mid-career (12%) or older workers (6%). Younger workers were also particularly inclined (13%) to emphasise value alignment as a key motivation for consolidation, distinguishing them from other age groups (7% and 2%).

However, significant barriers to consolidation persist. Almost 1 in 5 respondents (19%) expressed that they need more information to make informed decisions about consolidation, while 15% voiced concerns about exit fees, which are increasingly rare in modern pension funds. Only 6% of respondents were entirely unaware of pension pot consolidation.

Becky O’Connor, Director of Public Affairs at PensionBee commented: “Losing track of hard-earned pension savings is unfortunately more common than many savers realise. Missing savings can have a significant impact later in life, potentially forcing millions to work longer than necessary to afford a comfortable retirement. Here are a few practical measures that can help savers keep track of their pension savings throughout their lives.”

Practical Tips for Savers:

Keep all contact details updated: Changes in personal contact information are inevitable over the years. Savers should ensure they inform their pension providers of any changes to their home address, phone number, or email. If providers are unable to reach savers, important correspondence may be missed, leading to lost savings. Offering secondary contact details as a backup is also advisable.

Inform providers of name changes: If a saver changes their name—due to marriage or other reasons—they should inform their pension providers. Discrepancies in names can make it difficult for providers to locate previous pension records, increasing the risk of losing those pots.

Keep hold of paperwork: Although managing pension paperwork can be challenging, it’s essential for record-keeping. Important documents include provider names, policy numbers, and any additional retirement benefits. Having this information readily available can streamline the pension consolidation process.

Consider pension consolidation: For savers with multiple pension pots, consolidation can simplify management and reduce administrative burdens. It’s advisable to combine old workplace pensions into a personal pension each time a job changes, creating a single “home” pot to manage until retirement. This approach also allows savers to better assess their overall retirement savings and contributions.

Use the Pension Tracing Service: If savers are concerned about lost pensions, they can contact former employers and previous pension providers or utilise the government’s free Pension Tracing Service. This service offers a searchable database of pension provider contact details by employer name, helping individuals locate their lost pension pots.

Appendix

Table 1: Perceptions towards lost pension pots among UK workers

| Certain they have lost a pot (%) | Probably have lost a pot (%) | Unsure if they have lost a pot (%) | Probably have not lost a pot (%) | Certain they have not lost a pot (%) |

|---|---|---|---|---|

| 4% | 15% | 11% | 23% | 47% |

Source: Centre for Economics and Business Research and PensionBee, March 2024. Percentages have been rounded to the nearest whole number. Results are based on a survey of 1,957 UK adults and weighted to ensure they are representative of the UK population. Results are weighted on gender and age on an interlocked basis, and region, working status and social grade on a non-interlocked basis. The weighting is based on ONS data. The majority is from census data, 2020 for England, Wales and Northern Ireland, and 2021 for Scotland. However, working status is taken from the more regular labour force survey (excluding the time of COVID-19).

Table 2: Motivators for consolidating pension pots

| Motivators for consolidating pension pots | Overall percentage | Percentage of respondents aged 18-34 | Percentage of respondents aged 35-54 | Percentage of respondents aged 55+ |

|---|---|---|---|---|

| To make it easier to manage my pension | 30% | 33% | 34% | 23% |

| To save on pension costs | 24% | 29% | 26% | 18% |

| Nothing would motivate me to consolidate | 20% | 6% | 12% | 39% |

| I believe it may improve the performance of my pension | 19% | 24% | 22% | 13% |

| To make sure I don’t lose any pension pots | 17% | 20% | 20% | 10% |

| It was (or was) easy to do | 14% | 12% | 18% | 13% |

| Being offered a reward for doing so | 14% | 16% | 18% | 7% |

| More flexibility in managing my pension when entering retirement | 12% | 22% | 12% | 6% |

| Don’t know | 11% | 8% | 13% | 11% |

| To find a pension plan that suits my values | 7% | 13% | 7% | 2% |

| Other | 2% | 0% | 1% | 3% |

Source: Centre for Economics and Business Research and PensionBee, March 2024. Percentages have been rounded to the nearest whole number. Results are based on a survey of 1,957 UK adults and weighted to ensure they are representative of the UK population.

Table 3: Barriers to consolidating pension pots

| Barriers to consolidating pension pots | Percentage of respondents |

|---|---|

| No barriers | 30% |

| I don’t know enough to decide if consolidation is a good idea | 19% |

| I am not sure of the benefits of doing so | 16% |

| I don’t want to pay exit fees | 15% |

| I don’t know how to consolidate | 14% |

| I am worried about losing guarantees on my current pension | 13% |

| I don’t want to lose employer-matched contributions | 13% |

| Don’t know | 9% |

| I’ve never heard of consolidating pension pots | 6% |

| Other | 4% |

Source: Centre for Economics and Business Research and PensionBee, March 2024. Percentages have been rounded to the nearest whole number. Results are based on a survey of 1,957 UK adults and weighted to ensure they are representative of the UK population.

Figure 1: Forecasted total number of UK pension pots by 2050

Source: Centre for Economics and Business Research (CEBR) and PensionBee, March 2024. Forecasts for the average number of pension pots consider the current survey data average and forecasts for future attitudes to job change by age group and cyclical changes in job move rates using CEBR economic forecasts. The attitudes towards job changing utilise ONS labour market flow data and our wider forecasts for the UK economy. The averages are then scaled up to create a total number of UK pension pots using ONS population projections.