This is part of our monthly pension update series. Catch up on last month’s summary here: What happened to pensions in September 2022?

It’s been a time of great change in the UK, with political events unfolding alongside global economic themes, including high inflation and rising interest rates. There’s an interconnected relationship between inflation and interest rates; often when one is high, the other is low. Both have made headlines in recent months, but it’s important to remember that inflation and interest rates aren’t inherently bad. In moderation, they’re integral to growing the prosperity of a country. The difficulty occurs when one experiences instability and becomes too high or low.

High inflation is an economic ‘fever’ where symptoms include: a loss of appetite to spend money (due to rising prices), and a weakness in currencies. Central banks endeavour to provide the financial stability needed for a healthy, growing economy. So when inflation is running high, central banks may prescribe raising interest rates to lower the levels of inflation. This antidote of raised interest rates doesn’t correct inflation overnight and may have side effects of its own, such as it being more costly for you to borrow money for loans or mortgages, whilst also meaning more competitive rates for cash savers.

The danger of untreated inflation and interest rates is a recession, which economists are speculating is largely inevitable in the current climate. In fact, some news outlets have hypothesised we’re already in a recession. The combination of high energy prices, rising interest rates, and soaring inflation is the perfect recipe for a UK recession. The UK’s central bank, the Bank of England, is attempting to limit the damage of inflation by raising interest rates. Currently the Bank rate is 2.25% and the next update is due on 3 November 2022. However, ongoing interest rate rises are likely to dampen economic growth, leaving prominent risks to the UK economic outlook.

Keep reading to find out how markets have performed this month, what a recession is, and how a UK recession may impact your pension balance.

What happened to stock markets?

With economic uncertainty widespread, information has become the most important detail for dubious investors. Fortunately, October marked an opportunity for insights as many companies reported their quarterly earnings halfway through the month. For some, these mid-month trading updates launched an uplift in the value of company shares and stock markets alike, because many companies had better than expected profits, despite the economic turmoil. However, these updates can be a double-edged sword. A weaker outlook for Amazon sparked a turbulent downfall of more than 15% in their share price. Even companies that have had a successful October may still be far from their 2021 highs after this year’s continued period of market volatility.

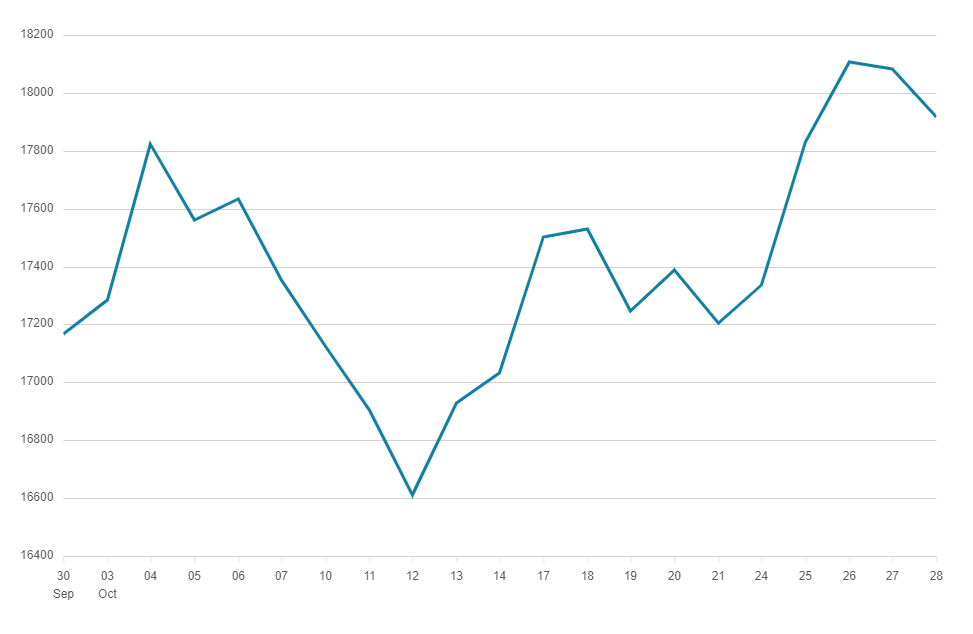

In UK stock markets, the FTSE 250 Index rose by almost 4% in October.

Source: BBC Market Data

Source: BBC Market Data

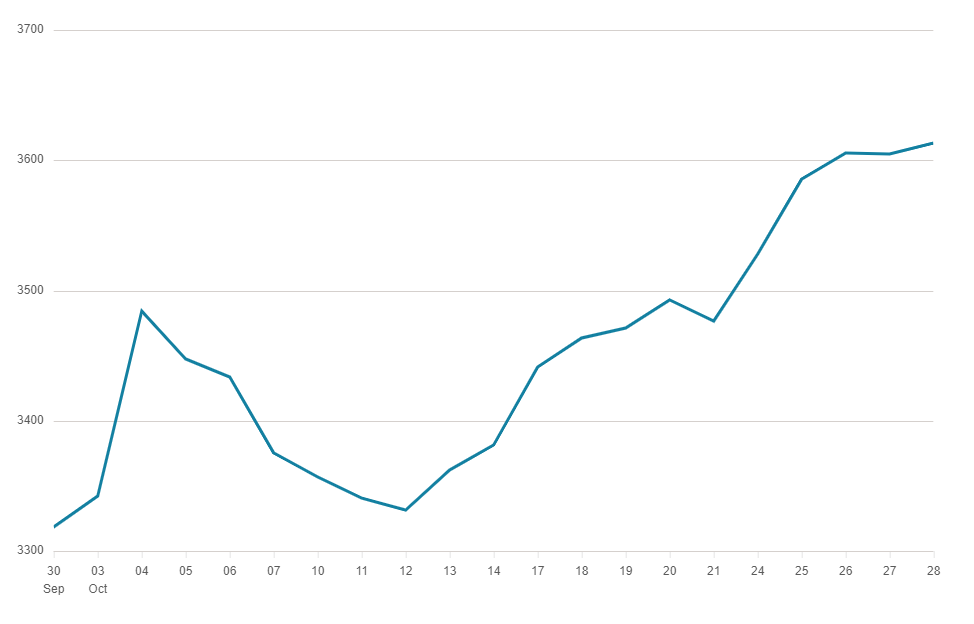

In European stock markets, the EuroStoxx 50 Index rose by almost 9% in October.

Source: BBC Market Data

Source: BBC Market Data

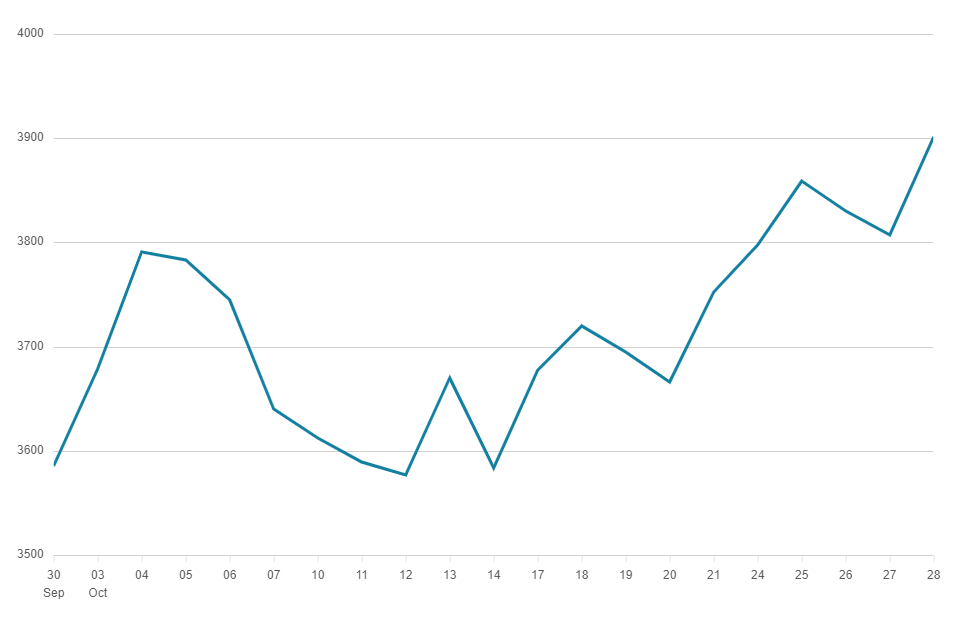

In US stock markets, the S&P 500 Index rose by almost 9% in October.

Source: BBC Market Data

Source: BBC Market Data

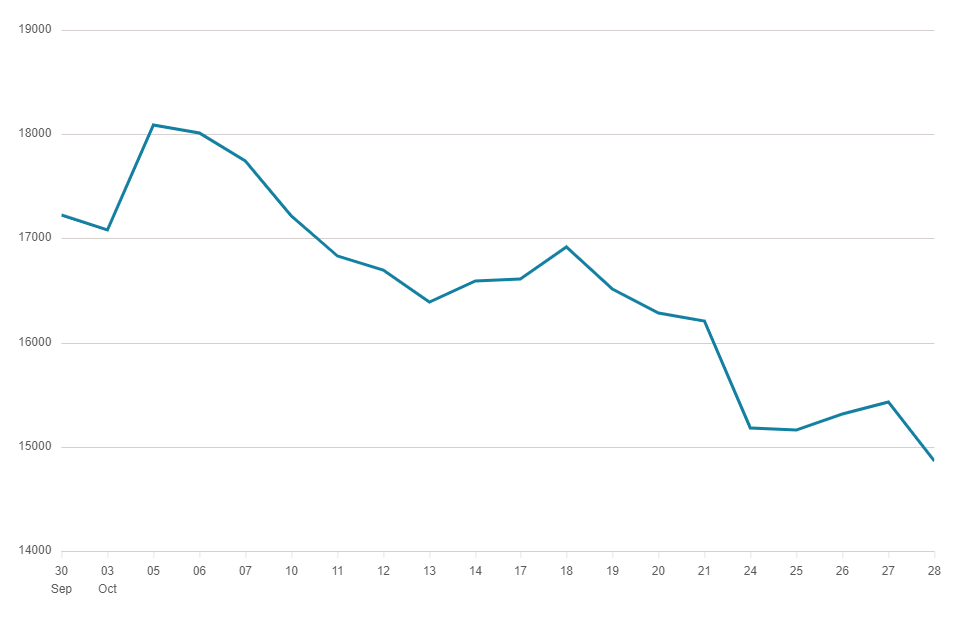

In Asian stock markets, the Hang Seng Index fell by over 14% in October.

Source: BBC Market Data

Source: BBC Market Data

Are we headed for a recession?

Qualities of a healthy economy include: increasing growth rate, high employment levels, and moderate inflation. The opposite, a weak economy, often features a decrease in economic activity, rise in unemployment, and volatile inflation. After two consecutive quarters of an economy contracting, a recession is confirmed.

What’s happening to the UK economy?

Gross domestic product (GDP) is a measure of the size and health of a country’s economy over a period of time. Similar to quarterly reporting conducted by companies, the country will announce similar results for how much they’ve grown or contracted. The table below shows the GDP of the UK economy since the previous recession, demonstrating a decline in the growth rate:

| Quarter of financial year | Performance of UK’s GDP |

|---|---|

| Q3 (July to September) 2020 | + 16.0% |

| Q4 (October to December) 2020 | - 9.8% |

| Q1 (January to March) 2021 | - 1.6% |

| Q2 (April to June) 2021 | + 5.5% |

| Q3 (July to September) 2021 | + 1.1% |

| Q4 (October to December) 2021 | + 1.3% |

| Q1 (January to March) 2022 | + 0.8% |

| Q2 (April to June) 2022 | + 0.2% |

Source: Office for National Statistics.

When was the last UK recession?

In the past 40 years the UK economy has experienced three recessions: the ‘Early 90s Recession’ (lasted five quarters between 1990 and 1991), the ‘Great Recession’ (lasted five quarters between 2008 and 2009), and most recently the ‘COVID-19 Recession’ (lasted only two quarters in 2020). Each occurred due to a unique combination of economic factors.

What does a UK recession mean for my pension?

During a recession, where numerous companies may report low growth, consumer confidence is relatively low and stock markets will usually reflect that. Pensions invested in stock markets may follow this trend downwards while the recession is ongoing. On the other hand, stock markets are usually forward looking, meaning a negative future economic period is already priced into company shares. Overall, it seems that volatility has good cause to continue.

Summary

We’re currently in a bear market (a period of economic decline). The good news is global markets have recovered from every bear market in history. Moreover, the value of most global markets not only recovers, but typically goes on to reach new highs. Even the biggest market crash since the Great Depression, the 2008 global financial crisis, was followed by the longest period of sustained growth in market history until the coronavirus pandemic struck markets in 2020.

As a general rule of thumb, when markets are down company shares become more affordable to investors. Putting your pension under a microscope, you’ll see that you probably own a very small percentage of many of the world’s largest and most successful companies, like Apple and Microsoft. When company shares have reduced in value, the same level of contributions can buy more shares. If you’re able to, consider adding to your pension pot to grow your pension in the long term as purchasing shares below their average price could give them more opportunity to grow.

You may find yourself rethinking your pension savings during the cost of living crisis, or worrying about whether you’re making the right choices. PensionBee customers can rest assured knowing that our pension plans are being managed by some of the world’s leading money managers. Again, it’s worth remembering that it’s normal and expected for pensions to go up and down in value over time. If you’re over the age of 50 and are considering your retirement options, you may benefit from a free Pension Wise appointment. You can book your appointment online.

This is part of our monthly pension update series. Check out the next month’s summary here: What happened to pensions in November 2022?

Have a question? Get in touch!

You can check out our Plans page to learn how your money is invested in different assets and locations. You can always send comments and questions to our team via engagement@pensionbee.com.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.