This is part of our monthly pension update series. Catch up on last month’s summary here: What happened to pensions in October 2022?

Markets have journeyed through choppy waters this year. In fact, over 87% of the S&P 500’s trading days in 2022 have endured swings of 1% or more. Between energy and food shortages as a result of the conflict in Ukraine, and supply chain issues from China’s manufacturing shutdowns, the perfect economic storm was born. The pressure of these supply chain issues has been felt intensely on the price of these commodities. In turn, inflation has risen as have interest rates.

The unpredictability of evolving global economic conditions led to many central banks, and investors alike, feeling lost at sea. Finally, recent weeks have revealed the direction of travel as the UK economy’s officially in recession, with many other European countries expected to follow suit. As we sail into 2023, will markets find a safe harbour for an economic recovery, or will next year be an encore of this year’s volatility?

Keep reading to find out how markets have performed this month, and how next year may impact your pension balance.

What happened to stock markets?

November has been a favourable month for investors, despite the current ‘bear market‘ environment. While movements in stock markets are often caused by business performance and political climates, a less tangible factor at play is confidence. Following months of variability, confidence has been in short supply creating a bleak outlook for investors.

What’s changed? The fog of uncertainty’s lifting, as central banks are expected to make smaller interest rate increases in future announcements. This slower pace has given rise to economic commentators anticipating when inflation and interest rates may peak. While the factors influencing market volatility continue, optimism, at least, is emerging.

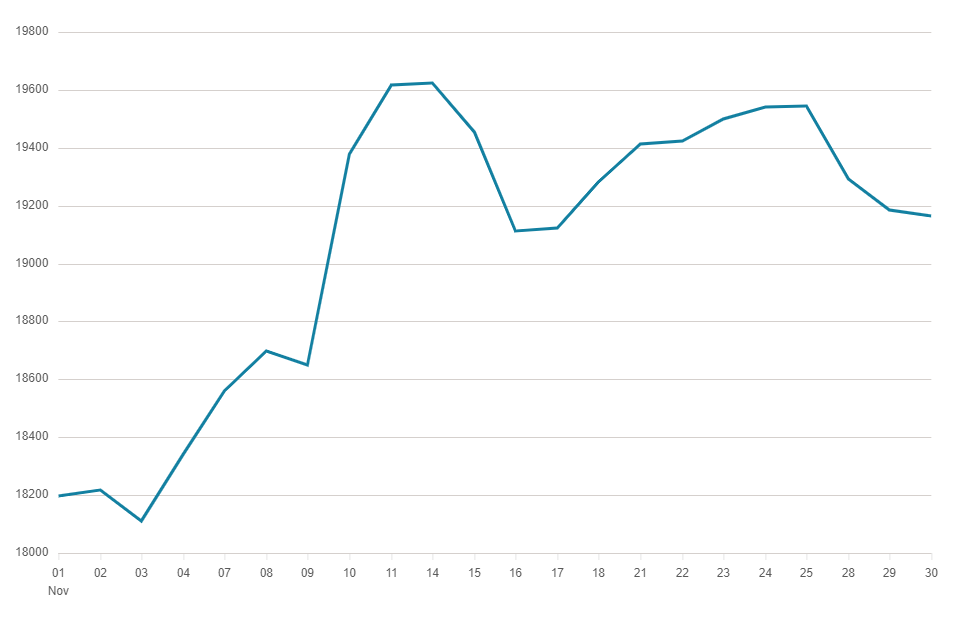

In UK stock markets, the FTSE 250 Index rose by over 6% in November, bringing the year-to-date performance close to -19%.

Source: BBC Market Data

Source: BBC Market Data

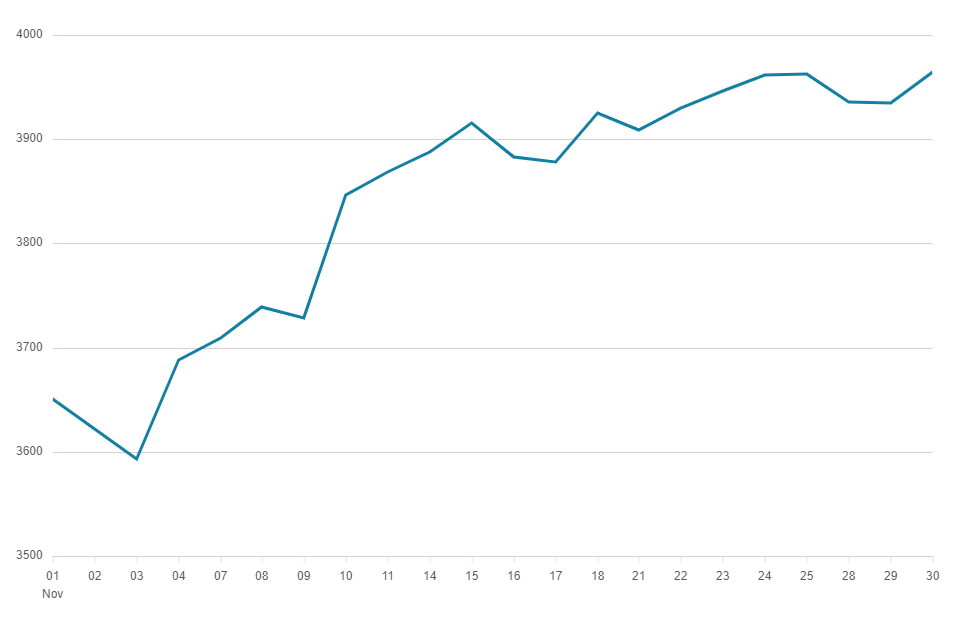

In European stock markets, the EuroStoxx 50 Index rose by over 9% in November, bringing the year-to-date performance close to -8%.

Source: BBC Market Data

Source: BBC Market Data

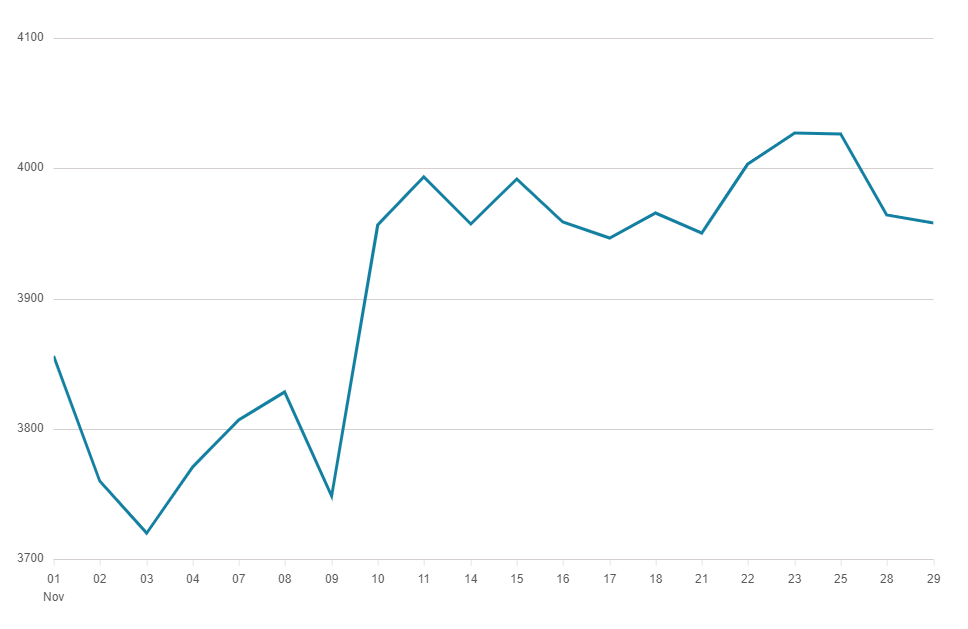

In US stock markets, the S&P 500 Index rose by almost 6% in November, bringing the year-to-date performance close to -15%.

Source: BBC Market Data

Source: BBC Market Data

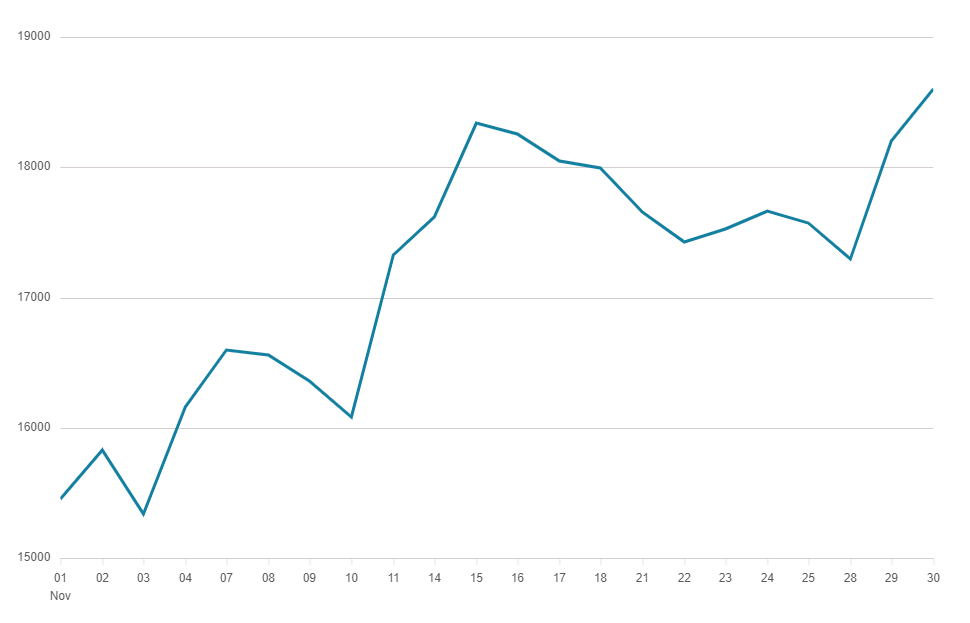

In Asian stock markets, the Hang Seng Index rose by over 18% in November, bringing the year-to-date performance close to -19%.

Source: BBC Market Data

Source: BBC Market Data

What’s the outlook for 2023?

The global economy’s looking weak going into 2023. Fortunately, global inflation is expected to peak in 2022. Recovery from this post-coronavirus economic crisis will move unevenly, with some countries and industries progressing faster towards growth than others. Goldman Sachs predicts companies in consumer goods, energy, and medicine will manage to grow due to their natural immunity against inflationary pressures on household spending.

Looking outward at global economies, the US (where the majority of pension equity is invested) is well positioned to be resilient and evade the recession that Europe’s entering. Even smaller economies are signalling hopeful returns in 2023, including emerging markets like Brazil. The long-awaited reopening of China should bring relief to manufacturing dependent industries. In short, it’ll be a bumpy ride back to the highs of late 2021.

As supply chains recover and inflation cools down over the course of next year, the fortunes of companies will be a mixed bag. Investors should heed a reminder about the importance of a well diversified portfolio to weather this volatile environment. The good news is that opportunistic investors may enjoy this prolonged sale on quality company shares.

Summary

We’re currently in a bear market. The good news is global markets have recovered from every bear market in history. Moreover, the value of most global markets not only recovers, but typically goes on to reach new highs. Even the biggest market crash since the Great Depression, the 2008 global financial crisis, was followed by the longest period of sustained growth in market history until the coronavirus pandemic struck markets in 2020.

As a general rule of thumb, when markets are down, company shares become more affordable to investors. Putting your pension under a microscope, you’ll see that you probably own a very small percentage of many of the world’s largest and most successful companies, like Apple and Microsoft. When company shares have reduced in value, the same level of contributions can buy more shares. If you’re able to, consider adding to your pension pot to grow your pension in the long term, as purchasing shares below their average price could give them more opportunity to grow.

You may find yourself rethinking your pension savings during the cost of living crisis, or worrying about whether you’re making the right choices. PensionBee customers can have peace of mind knowing that our pension plans are being managed by some of the world’s biggest money managers. Again, it’s worth remembering that it’s normal and expected for pensions to go up and down in value over time. If you’re over the age of 50 and are considering your retirement options, you may benefit from a Pension Wise appointment. You can book your free appointment online.

This is part of our monthly pension update series. Check out the next month’s summary here: What happened to pensions in December 2022?

Have a question? Get in touch!

You can check out our Plans page to learn how your money is invested in different assets and locations. You can always send comments and questions to our team via engagement@pensionbee.com.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.