During unprecedented times Faith (from Much More With Less) and I wanted to do something a bit different for PensionBee blog readers. Something that was entertaining, interesting, and thought provoking. Everyone loves a spending diary, right? Particularly in lockdown times. And to make it more fun we compared to each other.

We started on the 21st March, the day after schools closed, and wrote our diaries for a month until 20th April. You may have noticed that I’ve been publishing my own weekly spending diary posts on Mrs Mummypenny. I’ve already written six posts on weekly spends, thoughts and feelings and what we’ve been up to. This post is an added dimension of comparing one household to another.

So firstly, a bit of background. Faith and I do very similar jobs, both personal finance experts, writing on our own websites, for the media and our wonderful partners including PensionBee. Faith has two children, girl 12 and boy 10, and a husband. I have three boys, 12, 10, 7 and am divorced. We both live in four-bedroom houses, Faith in Suffolk, me in Hertfordshire. Faith’s house is a beautiful period house with a big garden full of flowers. Whereby my house is more modern, built in the 70s with an AstroTurf garden, with sadly very few flowers (footballs kill them)!

An overview

A spending diary is literally everything that we’ve spent money on for an entire month. Including all essential and non-essential spending. Even if it’s £1 on a newspaper it goes in the diary. We kept a detailed spreadsheet and categorised our spending in the same way.

In total Faith spent £2,362 and I spent £1,793.

Essential bills and spending

I’ll start with the essential bills. Firstly, the biggest bill (a mortgage) is missing for both of us. Faith is mortgage free (oh the dream!) and I’m on a mortgage holiday during corona times.

My bills for the month came to £333 and Faith’s came to £906. A big difference very simply explained by council tax and energy costs. This month was a break month for me council tax wise, saving £150 on my regular 25% discounted Band D council tax, whereas Faith paid (sorry my eyes are watering) £308. There’s not much that can be said here, or savings to be made. It is what it is.

Our energy costs are different as well. Faith decided to forward purchase heating oil whilst prices were low, costing £394, but it turns out the prices dropped by a further 50% after her purchase. Ouch. Plus Faith paid £50 to Bulb for electricity, compared to my £92 direct debit to Octopus for electricity and gas.

This leaves just £142 on the remaining bills for Faith and £241 for me. Mobile costs are very different for each household. I have four lines on my EE account, and it costs £92. This has now been renegotiated down to £50 from May, via switching my phone contract over to Sim only. Faith’s mobile costs for three lines are just £23. She’s done super well to get these costs so low!

Also, our broadband costs are vastly different. I pay £38 a month for super-fast Virgin (although I did get £170 cash back when I took out the contract!), Faith pays just £15 to Plusnet. I know Plusnet won’t work for me, we simply live too far away from the BT exchange in my village for the speeds to be high enough. Entertainment wise I also have Netflix for £8.99 a month, Faith must be the only person I know without it!

Groceries

Well what can I say, we both spent a fortune here. I spent £425 on a combination of two Aldi big shops, Co-op treats, top-up shops and Mindful Chef deliveries. I’ve been doing a big Aldi shop every two weeks and then popping to village butchers, corner shop and Co-op for any essentials in-between. I estimate that around £100 of the £425 was booze alone (insert shocked face emoji). I love to treat myself with Mindful Chef food, the dinners are amazing, restaurant quality, healthy and I love the cooking process. Save yourself £10 off boxes one & two if you sign up, search for the offer via Google!

Faith spent a similar £478 on groceries, a combination of big Morrisons deliveries, fruit and veg box deliveries and the milk man. Plus, some shopping for her mum who lives close by. Proving that shopping local unfortunately does cost more money. But is also supporting local business that might otherwise go bust.

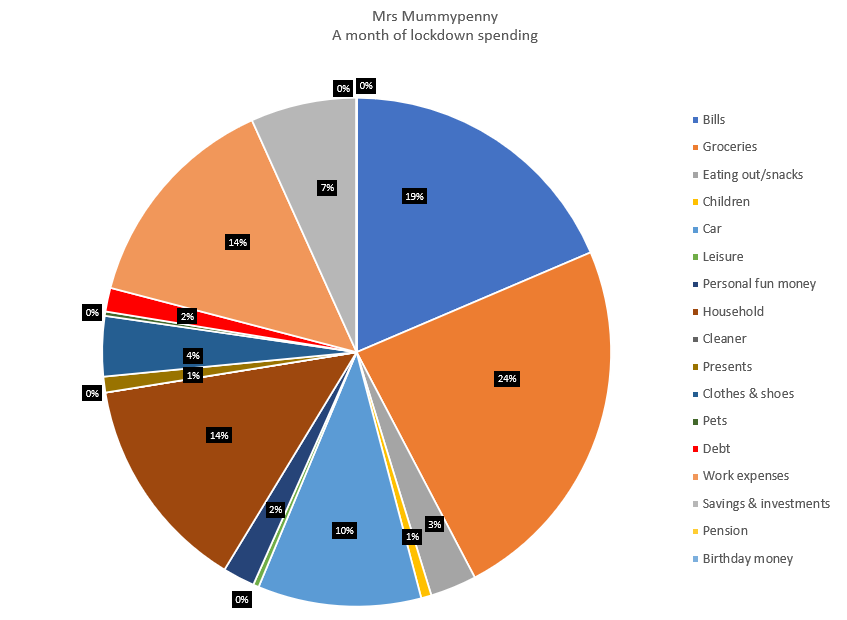

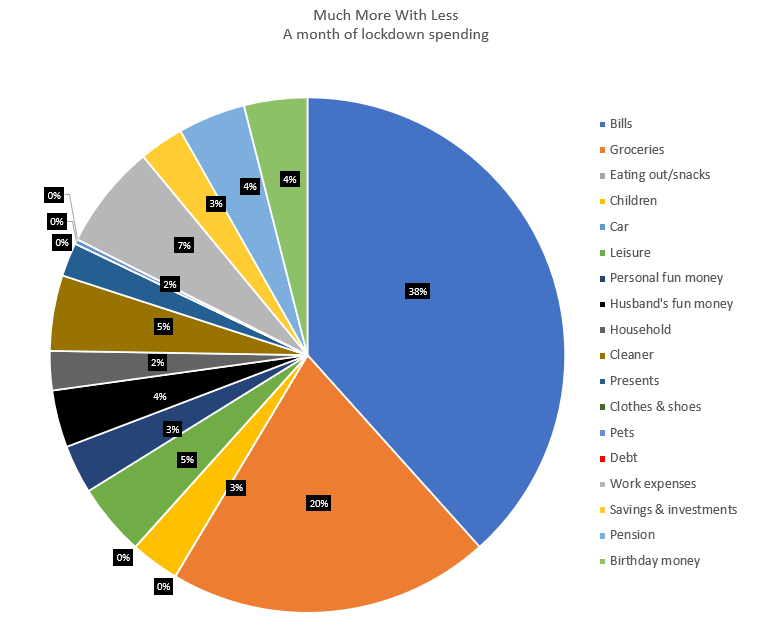

During a normal month both Faith and I spend around £300 on groceries, so this is much more than usual budgets. My grocery spend made up 24% of my monthly budget. It was 20% for Faith. On this note we have some colourful pie charts to demonstrate our spending. I love a pie chart, it’s my favourite graph to use for this kind of analysis (says the girl with a mathematics and statistics degree).

My pie chart is much more concentrated on four big areas, bills, groceries, work expenses and household expenses.

And here is Faith’s pie chart, with bigger chunks of spending on bills and groceries.

Car costs

My car costs are much higher than Faith’s as I have a car loan on my Toyota Hybrid CHR. This is a total cost of £186, including car tax. I simply couldn’t afford to buy a car outright, so have this super reliable and environmentally friendly car on finance. Faith had no car expenses. And neither of us put any petrol in our cars for the whole month!

Household expenses

These were high for me this month. This was due to an emergency house locks being changed (costing £120), new bedding, tap replacement parts and six months’ worth of contact lenses. A total of £247 or 14% of my budget. Faith didn’t have too many one-off strange costs in this category this month.

Work and business expenses

These were high for both of us. £254 for me and £156 for Faith. I have a virtual assistant (VA) which cost £120 this month. I also paid for a new email newsletter tool which will save me lots compared to my current tool (using Sendfox rather than Mailchimp). I spent £66 on a marketing course which was later refunded after the month period ended, because it was too basic for me. If you buy something and you’re not happy with it, get a refund! I also had podcast hosting costs and Microsoft costs.

Faith’s business costs were lower, but similar in type. She also paid for some SEO support similar to my VA. As well as IT costs, Microsoft and 1Tap pro (I have no idea what this is!!).

Fun money

We both feel that it’s important to have a fun money category in our budgets. This is money to spend on stuff just for us, and nobody else. This month I spent £26 on fudge (£18 alone on posh fudge), books, Audible trial (99p!!) and films (Once Upon a Time in Hollywood... £1.99 on Prime, I adore this film, and ADORE Brad Pitt on the roof scene).

Faith spent her fun money on Weight Watchers (how I laughed when I told her she had to put this in the fun category, sorry Faith), and flute lessons. Faith spent £72. Happy to report I have no husband fun money, Faith had £85 in that category.

Leisure and family spends

In here we include anything to do with our children and keeping them entertained. And it made me realise that I have been a scrooge here. Although shortly after the spending diary ended, I spent £70 on a new 3-metre pool for the garden.

I spent just £18 on books and a basketball net. The boys did get some new footballs too, but it was paid for by Nanny Vons Easter money.

Faith was more generous with £179 spent. This included piano lessons at £39, Yokie things (again no idea what this is!!) at £33 and various Nintendo gaming bits.

Eating out and takeaways

Faith did super well and spent nothing in this category when we had two Deliveroo deliveries for a Friday night treat spending £52.78. I can see this going up as takeaways start to re-open too. Already this week we’ve seen the Chinese and the Indian in my village re-open for socially distanced collection of takeaways.

Cleaner

Faith still pays her cleaner despite her not coming to her house, to help her out and keep her business going. I let my cleaner go last year, but think I’ll ask her to come back again after lockdown because I hate cleaning. It’s a luxury well worth paying for.

Savings and pensions

We’ve both taken these categories right down this month in transfer amounts. With the current times being so uncertain we’re both keeping more cash in immediate access accounts. Cash flow is king, and we simply don’t know what might happen to our self-employed income so money stays in cash. Faith did make a £100 contribution to her pension, I made £0. But I did auto-save £121.

Categories that have disappeared

This is so interesting to see! Petrol costs £0 for both of us. I easily spend around £120 a month on petrol previously. Childcare costs, school activities, school dinners and travelling to school have gone to £0 for both of us. Again, this was another biggish category probably costing around £150 a month for my three boys.

Charity contributions have gone, but I’ve since restarted this after the spending diary ended. I’m doing a May 500km challenge, where I will bike, run and walk 500km during the month of May. 10% of my turnover will go to Grief Encounter, as well as any money from my friends, readers and business partners!

Today I was up at 4:30 am, after 7 hrs unbroken sleep. Happy with that. I walked/biked a huge 30km yesterday, at 95km in my May #500kmchallenge. On target. Wore my @griefencounter t-shirt all the way (and lipstick👄👄). Would love a donation 😍🙏https://t.co/THKwAv5PZ6 pic.twitter.com/dbVrZ9r2rg

— Lynn Beattie (@MrsMummypennyUK) May 7, 2020

Summary

I’ve loved doing this challenge and comparing to a friend with a similar lifestyle. I’ve learnt that I have work to do with my essential bills, and that I can probably get my mobile phone costs lower and possibly broadband. Also, that I’m glad I don’t have a huge council tax bill!

I would love to live mortgage free but realise that this is an unrealistic expectation given my current recently divorced situation and living in an expensive South-East location. Likewise, I’d love to be without my car loan, a work in progress, and more achievable. I have around £12k left until its fully repaid. Although at 0% interest I’m happy keeping the payments at £175 a month!

I’ve learnt that I can be controlled and mindful with my spending when I need to. Cash is king currently and I’m doing everything I can to conserve the cash I have just in case I need it later down the line.

I’ve also learnt that I spent SO much on alcohol during the first month of lockdown. And I don’t regret it one little bit!

Lynn Beattie is a PensionBee customer and CEO/Founder of Mrs Mummypenny, a personal finance website. She is also an ACMA management Accountant, previously working in commercial finance for Tesco, EE & HSBC. Lynn is a single mum to three boys, living in Hertfordshire, and is the author of ‘The Money Guide to Transform Your Life‘ published in September 2020.