On Monday 10 December, the Minister for Pensions and Financial Inclusion Guy Opperman visited PensionBee at their offices in London Bridge to discuss the latest technological advances in the pensions industry and the future of pensions. Since 2014 PensionBee has been using technology, robotics and AI to help drive change for consumers across the pensions industry.

Minister for Pensions and Financial Inclusion, Guy Opperman MP said:

“Increasing people’s engagement with their pensions is at the heart of this Government’s modernising drive and it was interesting to see first-hand the work PensionBee are doing around e-signatures, transfers and automation. “Technology has a huge part to play in ensuring savers are better informed about the options out there, so they can make the right choices for their retirement.”

CEO of PensionBee, Romi Savova said:

“We are delighted the Minister is placing such an importance on the role of technology in shaping the future of pensions. Only through technology and customer engagement can we truly transform the pensions landscape, get people saving enough and ultimately prepared for a better retirement”

PensionBee took the opportunity to discuss the following issues with the Minister:

- Pension dashboards, why DWP musn’t delay commercial dashboards (as proposed in the recent feasibility study ), how Open Banking data standards and infrastructure must be used for pensions and why the single pension finder service is an outdated, single point of failure

- Slow pension transfers, sharing data and evidence on the slowest providers in the industry, calling for a 12-day Pension Switch Guarantee, and how a simple fix to Pensions Schemes Act 1993 would benefit consumers - PensionBee has recently written the Minister a letter on this topic and he will contact the worst offenders.

- Digital signatures, sharing data with the Minister on which providers still refuse to accept e-signatures - he is going to be writing to those providers to understand more on their objections and urge them to modernise.

What else happened?

During his visit, the Minister met PensionBee employees from the technology, marketing, design, operations and customer success teams and got a chance to ask lots of questions about how pensions of the future will work!

The visit began by meeting developers from the technology team who showed him their work to introduce pension administration procedures in Salesforce, the world-leading customer relationship management software, which allows for huge automation at scale and a unique customer-centric view of pension data.

The BeeKeepers and Nectar Collectors then introduced the Minister to the PensionBee army of ‘Armies’, or electronic signature robots, that help customers in the fight against backward pension providers who still refuse to accept digital signatures. The Minister showed particular interest in those 21 pension providers who still insist on ‘wet’ signatures and has promised to follow up with them individually. The Minister also had a chance to operate the ‘Millenium Falcon’, or the automatic letter reading robot that opens, scans, machine reads and responds to the thousands of letters that PensionBee receive by post.

PensionBee and the Minister then discussed issues of particular importance to PensionBee’s customers, who include 1_pension_age_from_2028 individuals from the Minister’s constituency, Northumberland. Specifically, while PensionBee robotics and automations have drastically sped up the transfer process for some paper providers, many administrators still take 2 - 3 months to release funds. PensionBee recently wrote to the Minister requesting a consultation on a Pension Switch Guarantee, something that the Minister will take away and look further into. Along with the issue of e-signatures and multiple pension finder services.

PensionBee’s highly engaged customer base is of particular interest to DWP. PensionBee customers are logging in 3 - 4 times a month to check their balance and 33% are making regular contributions averaging c.£300 a month, both are substantially higher compared to the rest of sector. DWP were also keen to understand more about the profile of PensionBee’s self-employed customers, who make up around _ni_rate of the customer base.

About PensionBee

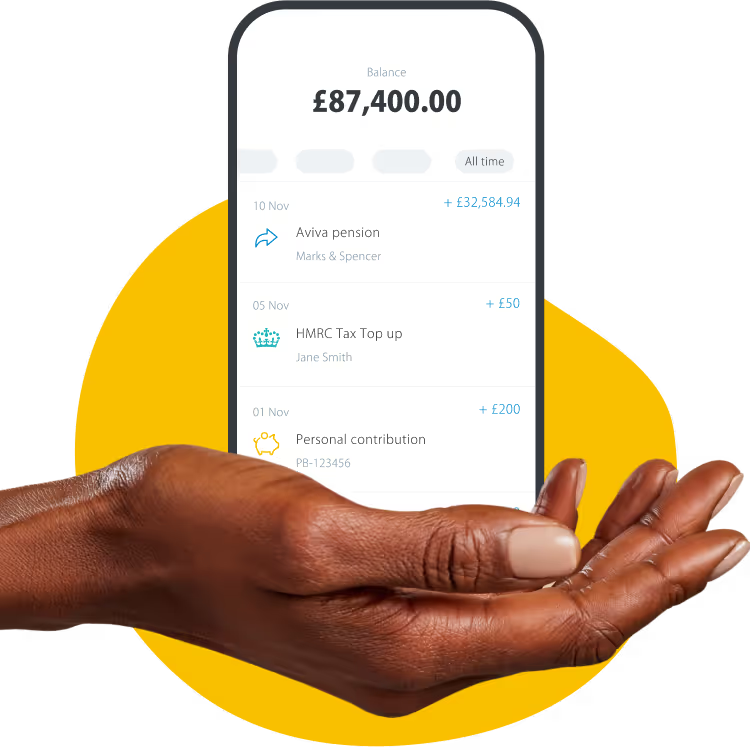

PensionBee is an online pension manager that brings old pensions together into one new plan managed by the world’s biggest investment managers. Customers manage their pension from their smartphone; add more pensions as they switch jobs, check their live balance, make one-off contributions and use a smart calculator to plan their retirement savings.

Recognised as one of the Fintech50, and as Schroders Leading Digital Platform of the Year 2018, PensionBee is the first and only pension company to bring their customers’ pension balances into the open banking revolution. Through its API, PensionBee has live integrations with Starling Bank, Yolt, Emma, Moneyhub and MoneyDashboard to empower their customers to see their entire financial universe in one place.

Note to press

- Link to photos

- Link to tweets

- Link to related story

- Link to DWP and PensionBee video on auto-enrolment

For more information, please contact Clare Reilly by email.