New research from leading online pension provider, PensionBee, finds that less than half (39%) of respondents feel confident about their retirement savings. _scot_higher_rate of savers admit that they don’t feel like engaging with their pensions, which includes checking their balance and making contributions, because it’s too complex.

The existence of thousands of pension products, which use complicated pension jargon, paired with complicated fees are often cited as causing inertia among consumers. However, PensionBee’s latest research also highlights the role of pension providers in this problem, in particular their failure to support their customers. 43% of respondents reported that they are not saving enough for retirement, and that their providers could do more to help them in their savings journey.

While 53% of savers are able to view their pension balance online at any time, a significant number of savers (47%) still receive an annual statement through the post. As a consequence of this lack of regular oversight, more than half of respondents (56%) admit that they are concerned about their pension savings, but do not know where to start in rectifying the problem.

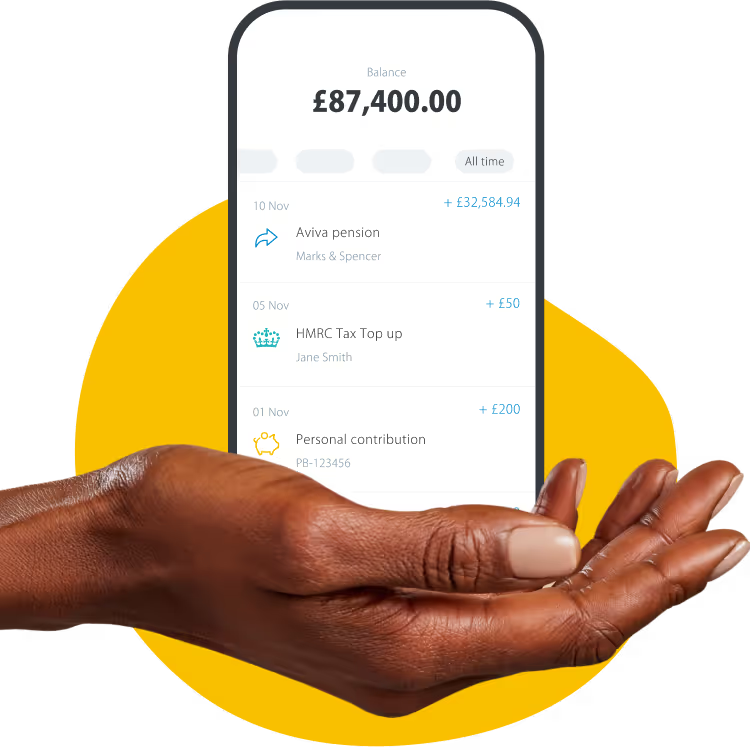

PensionBee CEO, Romi Savova, comments: “We’ve seen first hand that consumers feel more confident about saving for retirement when they can interact with their pensions online. Using proprietary technology and open APIs, we’ve made it easy for our customers to view their live balance, make contributions and withdrawals, and plan for the future, all while having full transparency on fees.

A wider adoption of modern technology across the pensions industry is needed if we are to tackle dwindling consumer confidence. Regular oversight over one’s pension not only aids in making informed financial decisions, but promotes a greater sense of ownership and engagement over their lifetime, which leads to better outcomes.”

Appendix

Table 1: Confidence level

Source: PensionBee, July 2021. 499 respondents. Numbers have been rounded.

Table 2: Engagement

Source: PensionBee, July 2021. 499 respondents. Numbers have been rounded.

Table 3: Perception of provider support

Source: PensionBee, July 2021. 499 respondents. Numbers have been rounded.

Table 4: How often savers can see the value of their pensions

Source: PensionBee, July 2021. 499 respondents. Numbers have been rounded.

Table 5: Perception of retirement savings

Source: PensionBee, July 2021. 499 respondents. Numbers have been rounded.