PensionBee finds that savers are contributing more to their pensions, and withdrawing less, during lockdown

London, Wednesday 13 May 2020: New data released by PensionBee shows lockdown has had a significant impact on savers’ contribution and withdrawal rates in April 2020, with tax year-end contributions increasing by over _higher_rate, and withdrawal rates down 33% year on year.

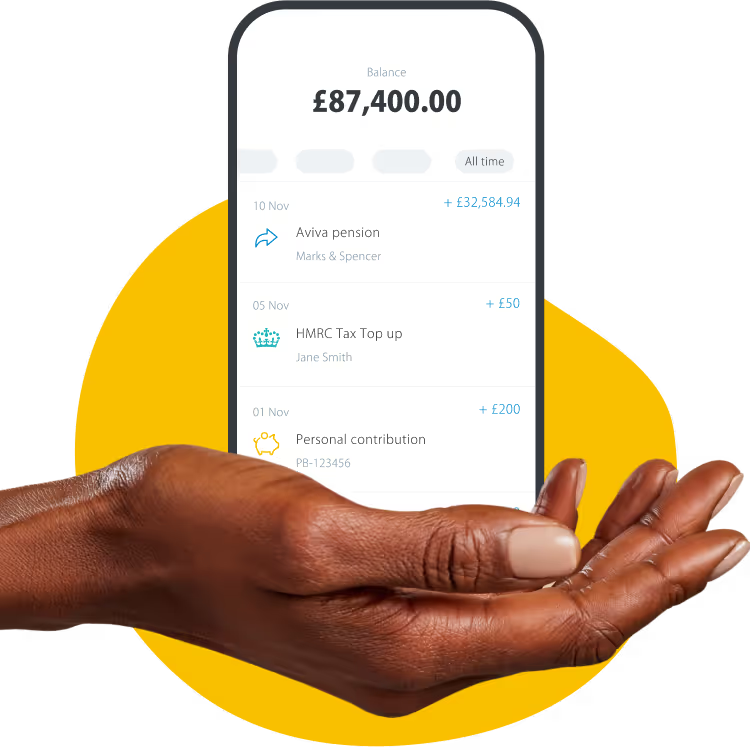

PensionBee, a leading online pension provider, has found that consumers are changing their financial habits during lockdown, with those who can afford to make larger contributions to their pensions saving significantly more in April, while those over the age of 55 are withdrawing less and keeping more of their pension savings invested.

While the overall proportion of people making pension contributions slightly fell in April this year compared to 2019, from _corporation_tax_small_profits to 17%, PensionBee found that the average monthly pension contribution had increased by 43%, from £1,225 in April 2019 to £1,752 in April 2020. The findings follow data released by market research company Ipsos Mori last month, which showed that as a result of lockdown, two thirds of Brits were spending less than usual, and almost a third were saving more (1).

PensionBee also found that in April 2020, the average pension withdrawal size reduced by _corporation_tax, declining from £10,900 in 2019 to £8,200. The proportion of customers making withdrawals decreased by 33%, year on year, with only 8% of customers aged 55 and over choosing to withdraw money from their pension in April 2020.

Despite many demands being placed on the country’s working population, PensionBee saw a 24% increase in customers who completed their first pension transfer in April 2020 compared to April 2019, signalling that consumers may be using their time in lockdown to organise their finances.

Romi Savova, Chief Executive of PensionBee, commented: “It is evident that consumers have become more prudent in an era of increased uncertainty, and where possible they are saving more and spending less. Where consumers are no longer spending money on everyday expenses such as commuting and eating out, they are redirecting their disposable income to their pensions. For those in retirement who are withdrawing less, prudence may be driven by apprehension about future spending requirements in the context of a weaker economy. We would encourage customers who have a larger disposable income to continue saving, and for those in retirement to keep as much of their pension invested as possible to ensure they’re well positioned to benefit from the eventual economic recovery.”

Appendix

Table 1: Rate of contributions

Source: PensionBee, April 2020. Based on 8,639 contributions in 2019 and 14,540 contributions in 2020.

Table 2: Average monthly pension contributions

Source: PensionBee, April 2020. Based on 8,639 contributions in 2019 and 14,540 contributions in 2020.

Table 3: Average pension withdrawal size

Source: PensionBee, April 2020. Based on 1,642 withdrawals in 2019 and 225 withdrawals in April 2020.

Table 4: Rate of withdrawals

Source: PensionBee, April 2020. Based on data in Table 5.

Table 5: Proportion of withdrawing customers

Source: PensionBee, April 2020.

Table 6: Number of customers who completed their first pension transfer

Source: PensionBee, April 2020.