- New report finds almost 1 in _years_before_ workers believe they have lost a pension pot worth more than _money_purchase_annual_allowance

- An estimated 4.8 million pension pots are already missing in the UK, with that figure set to rocket by 13_personal_allowance_rate by 2050

- Total number of UK pensions set to rise due to more frequent job switching and the impact of Auto-Enrolment

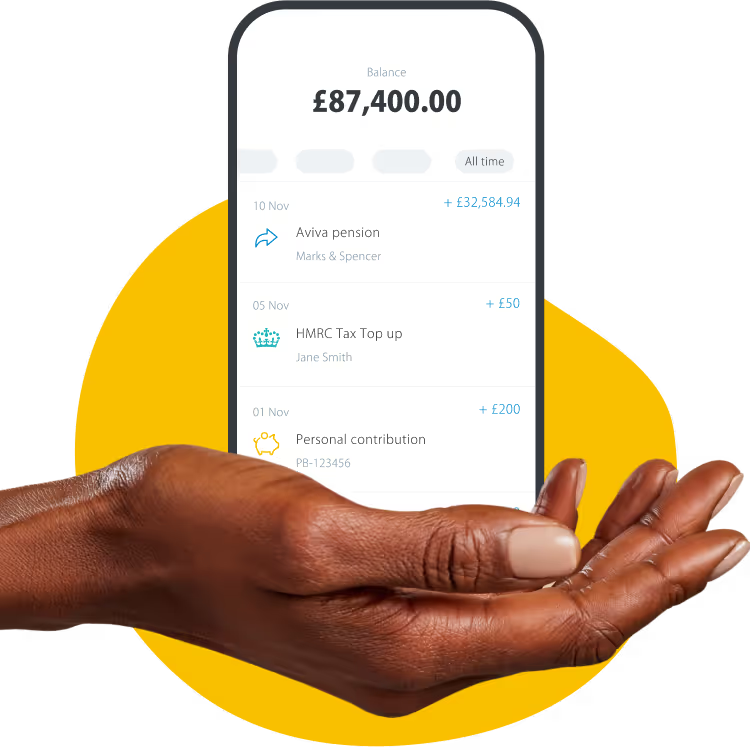

New analysis conducted by the Centre for Economics and Business Research, on behalf of PensionBee, reveals that over £50 billion pounds in hard-earned pensions are at risk of being misplaced in abandoned accounts or scattered across multiple lost pots.

The new research estimates that at least 4.8 million pension pots were considered to be ‘lost’ among the UK population in 2023, with nearly 1 in _years_before_ workers believing they could have lost a pension pot worth more than _money_purchase_annual_allowance.1

As the total number of UK pension pots is expected to rise 13_personal_allowance_rate, from _years_before_6 million (at present) to 243 million by 2050, the number of lost pensions could skyrocket. This is due to more frequent job switching among younger workers and as a result of the ongoing impact of Auto-Enrolment, which has significantly increased workplace participation since its introduction in 2012.

According to a sample of c.2,000 UK adults, younger workers (under ) have accrued a higher average number of pensions (2.4) than mid-career workers ( to 54 years old; 2.1) and older workers (+ years old; 1.7) despite a shorter career history.2

Meanwhile, today’s youngest workers (age ) are forecasted to accrue, on average, five pension pots by the age of . However, it is known for some people to accumulate more than twenty separate pensions over a working lifetime.

Younger workers were more likely to believe they had lost a pension pot (_corporation_tax) compared to mid-career workers (17%) and older workers () who, on average, had fewer pots to manage. PensionBee’s research also found that smaller pots, defined as being worth less than _money_purchase_annual_allowance, are more prone (1 of UK workers) to being misplaced compared to larger ones (9%).

Becky O’Connor, Director of Public Affairs at PensionBee, commented: “The amount of money lost track of in old pensions is already eye-watering, with more than £50 billion already at risk of being left behind, but is set to reach national crisis levels over the coming years, as the number of pots accumulated through work rises and with it, the number of lost pensions.

This research suggests the problem of lost pots is growing more urgent every year. The Government is working on a number of solutions to help solve it, including pension dashboards and new ‘pot for life’ proposals.

“For anyone who loses track of pensions, the result can, unfortunately, be a poorer retirement. It’s important to keep track of old paperwork, employer and pension provider names and policy numbers and if you would prefer to keep pensions together, consider consolidating them in one place.”

Christopher Breen, Head of Economic Insight at CEBR, commented: “Younger people are moving jobs more frequently than was the case for previous generations. While people tend to switch employers less frequently as they get older, this will still lead to a higher number of pensions being accrued. This is before accounting for the role of Auto-Enrolment.

Given this trend, it’s important that the government provides the necessary support and guidance for people to manage their pensions efficiently. With a rapidly ageing population, a healthy private pension system is vital for the long-term sustainability of public finances.”

Notes to Editors

Forecasts assume no change in policy to a ‘lifetime provider’ or ‘pot for life’ model, for which the government issued a call for evidence in the Autumn Statement.

Footnotes

- A ‘lost’ pension pot is defined as one in which the connection between the owner and the pot is currently cut off. This doesn’t mean these pension pots are lost forever and they’re likely recoverable.

- An average number of pension pots was created using respondents’ estimates of how many pots they have. Where they were unable to provide one, we asked them how many employers they had in various time periods and multiplied that by the average pension enrolment proportion for the period. The weighted average number of pension pots of the general sample is multiplied by the number of UK adults as per ONS census data from 2021 to find the UK-wide total.