Failing to actively engage with pensions during one’s working life could have a staggering financial impact, according to a new report from PensionBee, a leading online pension provider. The findings suggest that ineffective investment strategies, inadequate contributions, and poor pension management could cost savers hundreds of thousands of pounds over their lifetimes.

Ineffective investment strategy – potential cost: over _higher_rate_personal_savings_allowance,000

Over 9_personal_allowance_rate of pension savers remain in default funds, which while convenient may not maximise returns. A saver achieving just annual investment growth could accumulate £194,5 by age . However, those in a fund achieving 7% growth could amass £697,247—a staggering £503,061 difference.

Inadequate contribution levels – potential cost: over £190,000

Investing only the minimum required contribution into a workplace pension is common. However, a saver contributing 1 of their qualifying earnings instead of the minimum (5% personal contribution and employer contribution) could accumulate an extra £121,3_state_pension_age. Meanwhile, opting out of pension contributions for just three years at age 30 could reduce the retirement pot by £17,445, and delaying starting contributions until 30 instead of 21 could result in a £53,085 shortfall.

Poor pension management – potential cost: over

Paying high management fees and losing track of hard-earned pension pots can diminish retirement savings. Paying annual fees of 1% could shrink pension savings by £17,711, compared to paying fees of 0.7% Additionally, losing a _money_purchase_annual_allowance pension pot at age 30 could reduce your final pot by £23,544.

Analysis of PensionBee’s customers aged -54, in the accumulation phase of retirement saving, reveals how even small, consistent actions can lead to significantly better retirement outcomes.

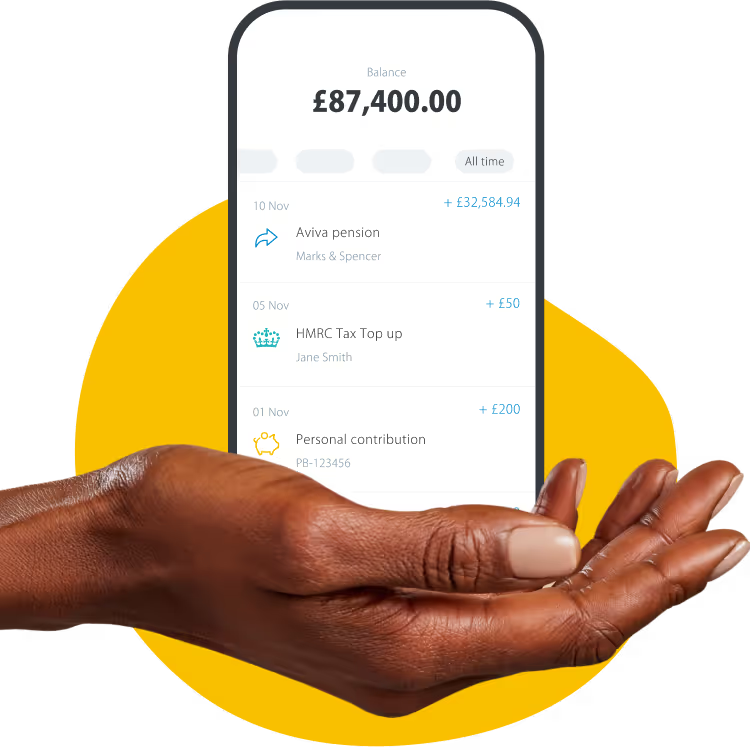

- Check your pension regularly: On average, customers who logged in to the app five times or more per month held pension values three times greater (£31,076) than those who logged in less frequently (£9,614). Across all age groups, more frequent logins correlated with larger pension pots.

- Be proactive: Customers who elected to switch from the default plan to more specialised funds held higher average pension values (£24,604) compared to those remaining in the default fund (£15,220).

- Engage with educational content: Customers who joined PensionBee at the same time with the same average pension value, who used the Pension Calculator tool 2-3 times saw their pots grow threefold in around six years, compared to pots doubling for those who didn’t, over the same period.

Lisa Picardo, Chief Business Officer UK at PensionBee, commented: “Engaging with your pension doesn’t have to be overwhelming. Many people put it off until retirement is near, by which time changing the outcome is much harder. But our research shows that small, early actions can make a profound difference.

Simple steps such as regularly reviewing your pension, consolidating old pots, and increasing contributions when possible can dramatically improve retirement outcomes. But the responsibility doesn’t only lie with savers. The pension industry must do more to support customers by simplifying fund information, making it easier to compare options and make informed decisions.

Government action is also key to empowering savers to build the retirement they deserve. Introducing a _years_before_-day pension switch guarantee would eliminate unnecessary delays, facilitate timely decisions, and allow savers to switch to providers that are more aligned with their individual needs or that offer better value for money.”

Appendix

Table 1: Impact of different investment growth rates on pension pot size at retirement

Assumes a starting salary of approximately £25,000 at age 21, average annual salary increases of , pension contributions from age 21 to 54, 0.7% in annual management charges and no withdrawals over the period.

Table 2: Impact of contribution rates on pension pot size at retirement

Assumes a starting salary of £25,000 at age 21, average annual salary increases of , pension contributions from age 21 to 54, annual investment growth, 0.7% in annual management charges and no withdrawals over the period.

Table 3: Impact of auto-enrolment opt out on pension pot size at retirement

Assumes a starting salary of £25,000 at age 21, average annual salary increases of pension contributions (from age 21 to 54), annual investment growth, 0.7% in annual management charges and no withdrawals over the period.

Table 4: Impact of starting ages for contributions on pension pot size at retirement

Assumes a starting salary of approximately £30,000 at age 30, average annual salary increases of , pension contributions from age 30 to 54, annual investment growth, 0.7% in annual management charges and no withdrawals during the period.

Table 5: Impact of paying 0.7% vs 1% in fees on pension pot size at retirement

Assumes a starting salary of £25,000 at age 21, average annual salary increases of , pension contributions from age 21 to 54, annual investment growth and no withdrawals during the period.

Table 6: Impact of paying 0.7% vs 1% in fees on pension pot size at retirement

Assumes a starting salary of £25,000 at age 21, average annual salary increases of , pension contributions from age 21 to 54, annual investment growth, and no withdrawals during the period.

Table 7: Impact of losing a _money_purchase_annual_allowance pension pot at age 30 on pension pot size at retirement

Assumes a starting salary of £25,000 at age 21, average annual salary increases of , pension contributions from age 21 to 54, annual investment growth, 0.7% in annual management charges and no withdrawals during the period.