London, 31 January : On the day of the Self-Assessment tax return deadline, analysis by PensionBee finds that 8_personal_allowance_rate of higher rate taxpayers are likely to be missing out on unclaimed tax relief on personal pensions amounting to more than £750 million a year.

PensionBee, a leading online pension provider, has found that approximately 8_personal_allowance_rate of higher rate taxpayers eligible to claim relief through their Self-Assessment tax returns are failing to do so, while an estimated 54% of additional rate taxpayers are inadvertently leaving tens of millions of pounds to HMRC.

Percentage of eligible taxpayers with unclaimed tax relief

Source: Gov.uk. Calculations are based on statistics from the Personal Pensions September 2019 National Statistics report which highlights that 9.4 million individuals contributed to a personal pension scheme in 2016/17 and _years_before_.4 million individuals in 2017/. The UK Income Tax Liabilities Statistics June 2019 Report highlights that 4.4 million individuals (14.1%) were higher rate taxpayers in 2016/17 and estimates 4.2 million individuals (13.5%) will be higher rate taxpayers in 2017/. It also highlights that 6,000 (1.1%) were additional rate taxpayers in 2016/17 and estimates 380,000 (1.) will be additional rate taxpayers in 2017/. We have only considered personal pensions that use the relief at source method and have explicitly excluded net pay schemes. Numbers have been rounded.

For higher rate taxpayers this equated to an estimated £770 million in unclaimed tax relief on personal pensions in 2016/17 and £769 million in 2017/. In the case of additional rate taxpayers, an estimated £50 million went unclaimed in 2016/17 and £61 million in 2017/.

Value of unclaimed tax relief

Source: Gov.uk. Calculations are based on statistics from the Personal Pensions September 2019 National Statistics report which highlights that average annual personal pension contributions per individual totalled £2,900 in 2016/17 and £2,700 in 2017/, likely an underestimate for higher and additional rate taxpayers. The number of eligible higher and additional rate claimants assumes a uniform distribution of pension membership among taxpayers; i.e. 14.1% of all taxpayers in 2016/17 were higher rate taxpayers and therefore 14.1% of all pension owners were higher rate taxpayers. There are some considerations around this assumption, as higher and additional rate taxpayers are more likely to have personal pensions, although they are also more likely to have remained in defined benefit schemes or opted out after having exceeded the lifetime allowance. Higher and additional rate taxpayers are also more likely to be members of salary sacrifice schemes, meaning there may be a lower proportion making personal pension contributions. Calculations take into account that higher and additional rate taxpayers can claim a further _corporation_tax and 31% through their Self-Assessment respectively, based on tax rates in England, Wales and Northern Ireland. We have only considered personal pensions that use the relief at source method and have explicitly excluded net pay schemes.

The news comes on the deadline for filing Self-Assessment tax returns, following a freedom of information request made to HMRC by the online pension provider. It serves as a reminder to higher and additional rate taxpayers, who may not be thinking of registering for Self-Assessment, to consider how much tax relief they could be owed.

How tax relief works

There are two ways that consumers receive tax top ups on their pensions: via the “net pay” system or via “relief at source”. The former approach is generally adopted by trust-based schemes (regulated by The Pensions Regulator), while the latter is used by personal pensions (regulated by the Financial Conduct Authority). Personal pensions are not necessarily set up by an individual, and many employers use Group Personal Pensions for Automatic Enrolment, meaning impacted consumers will have had little involvement in the provider selection process.

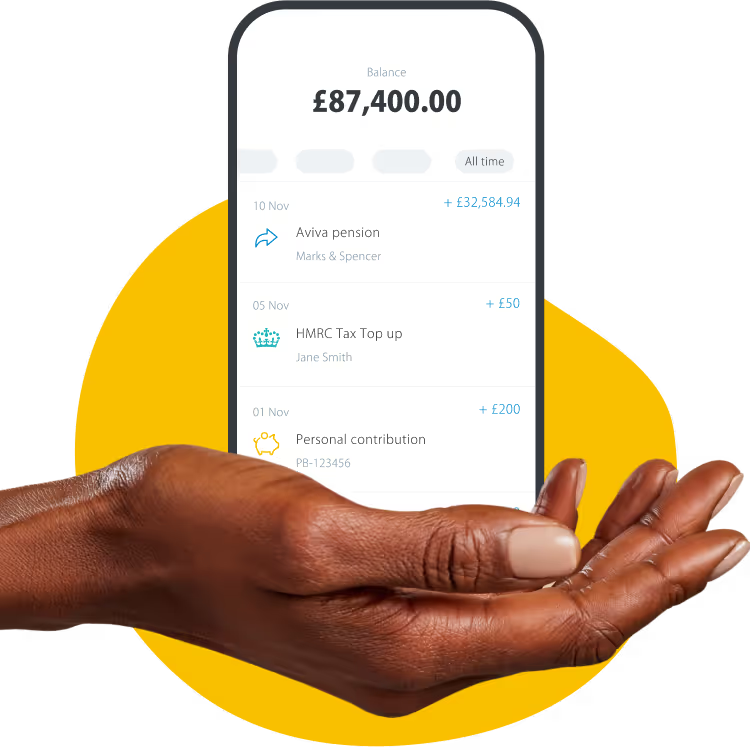

The relief at source system for personal pensions, which had _years_before_.4 million consumers in 2017/, requires pension providers to claim basic rate tax top ups on behalf of their customers and put it in their pensions. For example, if a basic rate taxpayer pays _bereavement_standard_monthly into their pension, the provider would claim £25 from HMRC and put it in the customer’s pension, bringing the total contribution to _lower_earnings_limit.

Higher rate and additional rate taxpayers receive this _corporation_tax tax top up and can then claim an additional _corporation_tax and 31% tax top up via their Self-Assessment respectively. Many higher rate and additional rate taxpayers will have no need for a Self-Assessment if they are in employment and otherwise deal with their tax matters exclusively via payroll (PAYE).

It’s important to note that you don’t need to be self-employed to register for Self-Assessment, however you should only attempt to claim tax relief this way if you earned more than the basic rate tax threshold and contributed to a personal pension. You may need to check your paperwork or ask your employer about the type of pension you are enrolled in.

There’s a time limit of four years to claim back tax relief from HMRC. A claim must be made within four years of the end of the tax year that’s being claimed for.

Romi Savova, CEO of PensionBee, commented:

“A lack of awareness of how the tax relief system works means that too many people are missing out on one of the key benefits of pension saving. While relief for basic rate taxpayers is automatically added to a pension as a tax top up, any further tax relief owed to higher and additional rate taxpayers must be claimed through Self-Assessment. This is yet another reason why the pensions system is in need of dramatic simplification.”