Featured articles

What is investing?

Investing can seem daunting at first, but with the right approach, it can be a tool to help you achieve your financial and retirement goals. By understanding the basics you can put your money to work and build towards long-term wealth.

When you invest, you’re buying an asset - whether that’s a company’s stock, a piece of real estate, or a bond issued by a government or corporation. The idea is that over time, the value of your investment will grow, and you can then sell it for a profit. Of course, investing also carries risks - the value of your investment could go down, resulting in a loss.

Types of investments

There are many types of investments to choose from, each with their own level of risk and return.

Here are some of the most common:

- Stocks - also called equities. When you buy a stock, you become a partial owner of the company that issued it. If the company grows and becomes more valuable, the price of the stock should rise. You can then sell it for a profit.

- Bonds - a form of loan from a government or company. In return, they pay you interest over a set period of time and then repay the original amount you lent them.

- Property - investing in property (residential or commercial) can create rental income. This could appreciate over time if the value of the property increases.

- Cash and cash equivalents - such as savings accounts, money market funds, and short-term government bonds.

- Alternative investments - including commodities (materials like oil, wheat or gold), cryptocurrencies, hedge funds and private equity (companies not quoted or traded on a stock exchange). These investments are typically higher risk so you’re less likely to be investing in commodities unless, for example, you’re a sophisticated investor or investing on behalf of an institution.

Why invest?

There are several key reasons why people choose to invest their money:

- Potential for growth - over the long-term, investments like stocks and property have the potential to grow in value. This can help your money work harder for you and build wealth.

- Income generation - both property investments and stocks/assets have the potential to provide you with a regular income stream. This could be in the form of interest payments or rental earnings that can add to your other sources of income.

- Inflation protection - keeping your money in cash savings can mean its purchasing power gradually drops over time due to inflation. Investing in assets that have the potential to grow in value is one way to help protect your money against this.

- Diversification - spreading your money across different types of investments could help reduce your overall risk, as they’re likely to perform differently.

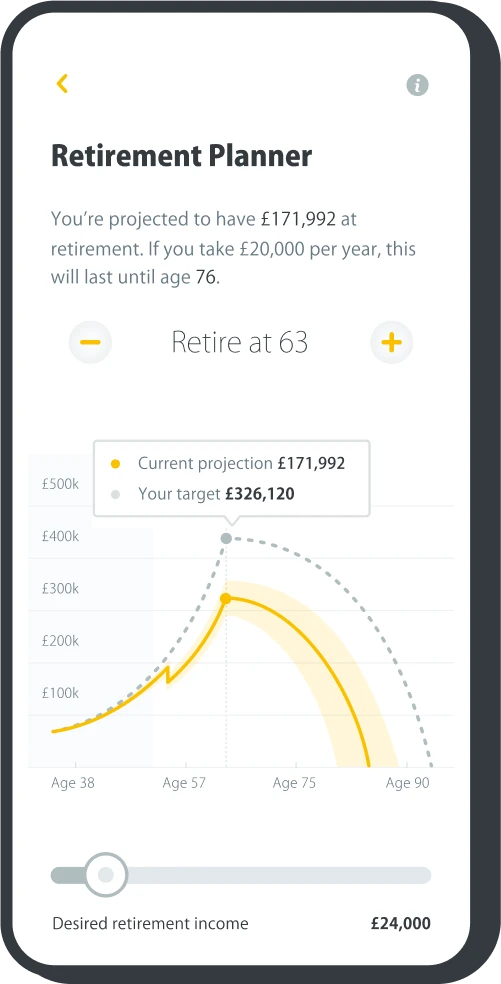

- Retirement planning - investing through tax-advantaged accounts like pensions, can be a crucial part of building a reliable retirement income.

Be pension confident.

Combine your old pension pots into one new online plan. It takes just a few minutes to sign up.

Get startedHow does investing work?

Once you’ve chosen your investments, you’ll need to track them and decide when to buy, hold, or sell. This is where investment research, strategy, and discipline come into play. Successful investors typically take a long-term, diversified approach. They might also avoid the temptation to constantly buy and sell.

It’s also important to consider the tax implications of your investments. In the UK, there are various tax-efficient accounts like ISAs and pensions available.

The return you earn on your investments can come in a few different forms:

- Capital gains - this is the profit you make when you sell an investment for more than you paid for it. For example, if you buy a stock for £10 and sell it later for £15, you’ve made a £5 capital gain.

- Dividends and interest - many investments, such as stocks and bonds, pay out regular income as dividends or interest payments. A dividend is a payment a company can make to shareholders if it has made a profit. This could provide you with a steady stream of returns, alongside any capital gains.

- Rental income - for property investors, the rent paid by tenants is a key source of investment returns.

Getting started with investing

It can feel daunting to take the first step into investing but you may already be doing it without realising, through your pension or savings accounts.

Here are some other things to consider:

- Determine your goals and risk tolerance - think about what you want to achieve with your investments. That may be saving for retirement, a house deposit, or another long-term financial goal. It’s also crucial to consider how much risk you’re comfortable taking on.

- Ensuring you have an emergency fund/accessible savings - should you need to access money for any reason you don’t want to dip into long-term investments.

- Educate yourself - there are many great resources available to help you learn the basics of investing. Read books, listen to podcasts, and take the time to understand different asset classes and investment strategies.

- Start small - you don’t need a huge amount of capital to begin investing. Many well-known platforms allow you to start with small amounts. The UK’s first investment platform for women, Propelle will let you start with £1. This can help you get comfortable with the process and build your confidence in small steps.

- Diversify - don’t put all your eggs in one basket. Spread your money across a range of different investments to manage your risk.

- Use tax-advantaged accounts - with ISAs you pay no income tax on the interest or dividends you make. Any profits from investments are free of capital gains tax (CGT). There are also various tax advantages to the different types of pensions.

- Automate your investments - set up regular payments into your investment accounts to make the process easy and consistent.

- Seek professional advice - if you’re unsure about investing, consider speaking to a qualified Independent Financial Adviser (IFA) who can provide personalised guidance.

Investing can seem daunting at first, but with the right approach, it can be a tool to help you achieve your financial and retirement goals. By understanding the basics you can put your money to work and build towards long-term wealth.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

Last edited: 06-04-2025