Featured articles

Pension investments

If you’re saving into a pension, you might not be aware that your money is in fact invested and may even be wondering how and why it is.

When you invest in a pension, you’re not just stashing your money away, instead, your contributions are typically invested in a range of assets like stocks, bonds, and property. The aim is to grow your pension pot faster than inflation, with the aim of leaving you with a healthy retirement fund to enjoy when you finish working.

The asset classes that make up your pension pot have their own pros and cons. To balance these, your pension will usually include a variety of different investments, collectively known as a fund. A fund will usually invest across multiple asset classes, regions and industries, to spread the risk. This is a process known as diversification (more on this later).

Your pension invests differently across each asset class to suit different levels of risk. The right level of risk for you will depend on your circumstances, as well as how close you are to retirement.

For example, a higher risk pension plan might invest more in company shares, which tend to grow faster, but have a higher chance of being impacted by market volatility. These might be suitable for younger investors, who need to grow their pension and have time to weather fluctuations in the stock market.

Those approaching retirement age tend to want more predictability and less fluctuation. These types of plans might invest more in bonds, which aim to provide more moderate growth, and are less likely to be impacted by market volatility.

Why invest in a pension?

Tax benefits

Most UK taxpayers receive a 25% tax top up on their personal pension contributions. This means the government effectively adds money to your pension pot, boosting your savings. For example, basic rate taxpayers usually get a 25% tax top up, so if they contribute £100 into a personal pension, they’d receive an extra £25 from the government making it £125. Higher and additional rate taxpayers can usually claim back extra tax relief through a Self-Assessment tax return.

Employer contributions

Thanks to Auto-Enrolment, employers must now put all eligible workers into a workplace pension scheme.

You’ll be eligible if you:

- work in the UK;

- are at least 22 years old;

- haven’t reached State Pension age;

- earn more than £10,000 a year; and

- aren’t already a member of a suitable workplace pension scheme.

If you earn less than £10,000, but above £6,240, your employer doesn’t have to automatically enrol you in their scheme. However, if you ask to join, your employer won’t be able to refuse you and must make contributions on your behalf.

Whilst you’ll have to contribute at least 5% of your annual qualifying earnings, your employer will add at least another 3% of your annual qualifying earnings on top.

Compound growth

Pensions grow in value through two main ways; contributions and investment returns. Any growth is then amplified by compounding. Put simply, this is where you build up interest on the interest you’ve already earned on your savings.

This means you earn interest not just on your original contributions but also on the interest that accumulates.

You can view this like the snowball effect for your pension. The longer your money stays invested and the more you pay in, the more your pension grows.

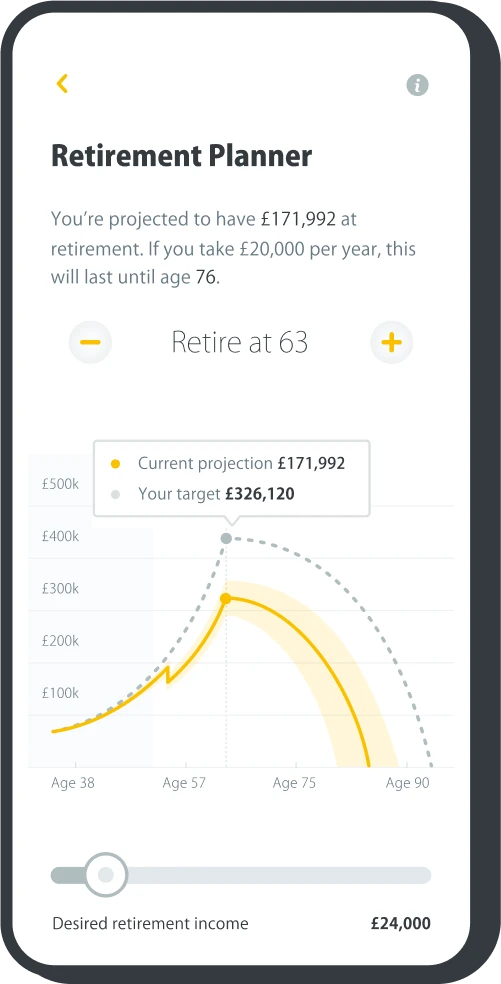

Flexibility at retirement

When you reach 55, rising to 57 in 2028, you can access the money in your pension pot in a number of different ways. When it comes to choosing which is right for you, it very much depends on your specific circumstances and goals - there isn’t a one-size-fits-all approach. You can even use a mixture of options, rather than having to rely on one.

For example, maybe you’d like to pay off some debt or do some home improvements. You could take a portion of your pot as a tax-free lump sum and leave the rest invested to draw down from as and when you need.

Another option is to use pension drawdown at the start of your retirement and consider purchasing an annuity later in life. In the early days of your retirement, you might still want the flexibility of being able to access your money whenever you like. Then as you grow older, you might prefer the guaranteed income that comes with purchasing an annuity. The choice is yours and that’s why when the time comes it’s important to understand all your options. If you’re aged 50 or over, it could be worth booking a free Pension Wise appointment from MoneyHelper to better understand all of your options before accessing your pension.

Investing in a pension is a good way to ensure you have a steady income in retirement and ensure you’re able to live the type of retirement you’d like. With the added benefits of tax relief and potential employer contributions, it’s an opportunity not to be missed.

Be pension confident.

Combine your old pension pots into one new online plan. It takes just a few minutes to sign up.

Get startedHow much investment knowledge do you need to invest in a pension?

Different types of pensions need different levels of investment knowledge.

Defined contribution pensions

Most modern workplace and personal pensions, including PensionBee pensions, are defined contribution pensions. A defined contribution pension’s value will depend on how much money you’ve invested, as well as how your investments perform.

Workplace pensions

Workplace pensions are set up by your employer. You don’t have to pick investments yourself, as your employer’s pension scheme does it for you. Some offer a choice of fund, so it’s worth checking with your employer to find out if there’s one that better suits your needs.

Personal pensions

A personal pension is set up by you, so you have responsibility for where and how much you invest.

There are broadly two types:

- Ready-made funds - these are collections of investments, designed to make it easy for you to save. They’re great if you don’t have time to manage your investments yourself, or you lack the experience. Simply choose one that best suits your financial goals or aligns with your beliefs and the fund manager will make any investment decisions.

- A SIPP (Self-Invested Personal Pension) - these are on the other end of the scale. A SIPP gives you complete control to choose your investments, so you decide where and much you invest. The key benefit of a SIPP is the freedom to choose from a wide range of investments and asset types. But you’ll need the time, knowledge and confidence to manage your investments effectively.

Defined Benefit pensions

A defined benefit (or ‘final salary’) pension is another type of workplace pension. A defined benefit pension will pay you a retirement income based on your salary and the number of years you’ve worked for the employer. These typically need very little knowledge of investing, as the scheme’s trustee’s will make decisions on your company’s behalf.

What to consider when investing in a pension

How much control do you need?

A SIPP offers you the greatest control over your pension, but offers little or no guidance. This makes them well-suited to confident investors.

Ready-made funds take care of the investing for you. You can still choose a fund aligned with your financial goals, but you can take a more hands-off approach.

Fees and inflation

All pensions will charge fees of some kind. On their own they might look small, but combined they can add up, particularly over the course of many years. Understanding the fees you’re paying - and switching if necessary - could save you money.

At PensionBee we charge a single annual management fee, which is taken directly from your pension pot. If you’re making a special request, we may charge fees for additional services. There are no hidden provider fees or platform fees with PensionBee.

Inflation also affects your pension’s value. Inflation is the rate at which the cost of everyday goods increase. If your pension isn’t increasing in line with inflation, then the value of your savings is decreasing. Use our Inflation Calculator to understand how far your pension savings could go in retirement.

What level or risk works best for you?

Risk can sound scary, but all pension investments take on some level of risk. Pensions will focus on different assets, or use a balanced mixture, to achieve their goals.

Higher-risk assets, like company shares, have the potential to grow your pot the most over the long-term. These can be sensitive to market volatility, so their value might fluctuate during economic downturns. A fund that invests more in these might make sense for the young or middle aged, as these groups tend to be focused on growing their pot and have more time to ride-out any downturns.

Lower-risk assets, like bonds and cash deposits, tend to grow at a slower rate, but offer more predictability. A fund that invests more in these might be suitable for those approaching retirement, since they tend to need more stability.

Have you diversified your investments?

Investing too much in one area is like putting all your eggs in one basket, whereas diversification is like putting your eggs into lots of baskets. If you invest across different asset classes, regions and industries, you spread the risk. This means that if there’s a loss in one of these areas, it could be offset by growth in other areas.

Most ready-made funds are already made up of a broad range of different assets for this reason. How much they invest in these different asset classes changes as you go through life. This means it spreads the risk and also adapts to your risk profile as you get older.

Have you consolidated your pensions?

If you have several pension pots, consolidating your pensions can be a good way to get on top of your retirement savings. Consolidating can make it easier to keep track of your investments and ensure you’re not paying multiple fees.

Review your investments regularly

A pension is a long-term investment and many things can change over time. Regularly checking your investments can ensure that your pension continues to work for you.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

Last edited: 06-06-2025