This is part of our monthly pension update series. Catch up on last month’s summary here: What happened to pensions in August 2024?

The US Federal Reserve (America’s version of the Bank of England) recently cut interest rates in a bid to boost the US economy. This decision not only impacts the US, but can also create a ripple effect around the world.

When interest rates are cut borrowing becomes cheaper, so companies usually take the opportunity to invest in their growth. Consumers are also able to borrow more, so demand for goods and services increases as they begin to spend more. Investors will often take the opportunity to move their money into the stock market to make the most of the boost, which can increase companies’ stock prices further.

So why does this matter to you? Your pension is likely to be invested in US companies via the main US stock market - the S&P 500. Among the 500 companies listed are Apple, Google and Nvidia which are often referred to as the ‘Magnificent Seven’. Due to their high valuations, most pension funds will be invested in them.

Keep reading to find out what the changing US interest rate could mean for your money.

What happened to stock markets?

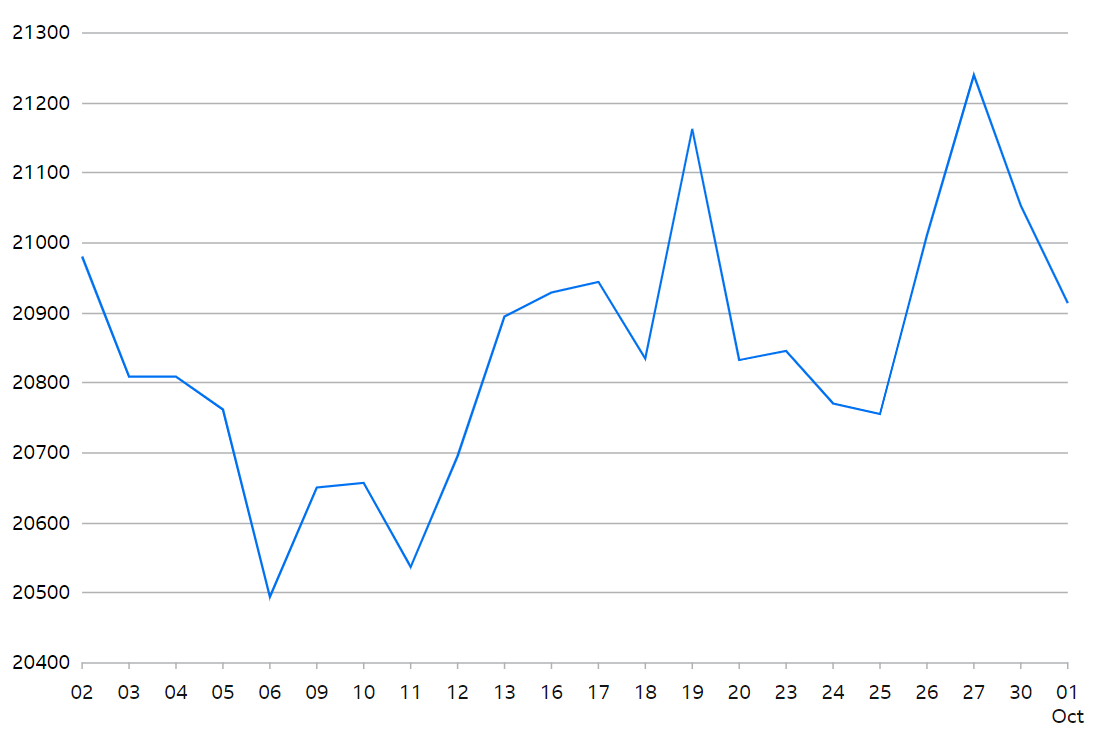

In the UK, the FTSE 250 Index remained the same in September. This brings the year-to-date performance close to +7%.

Source: BBC Market Data

Source: BBC Market Data

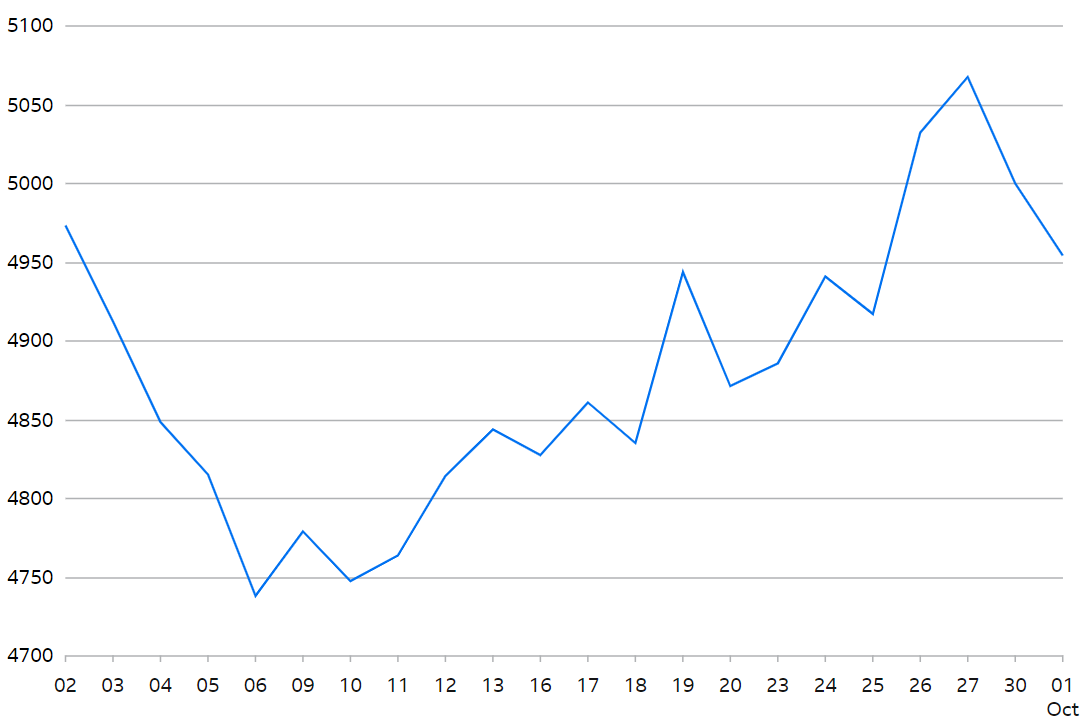

In Europe (excluding the UK), the EuroStoxx 50 Index rose by almost 1% in September. This brings the year-to-date performance close to +11%.

Source: BBC Market Data

Source: BBC Market Data

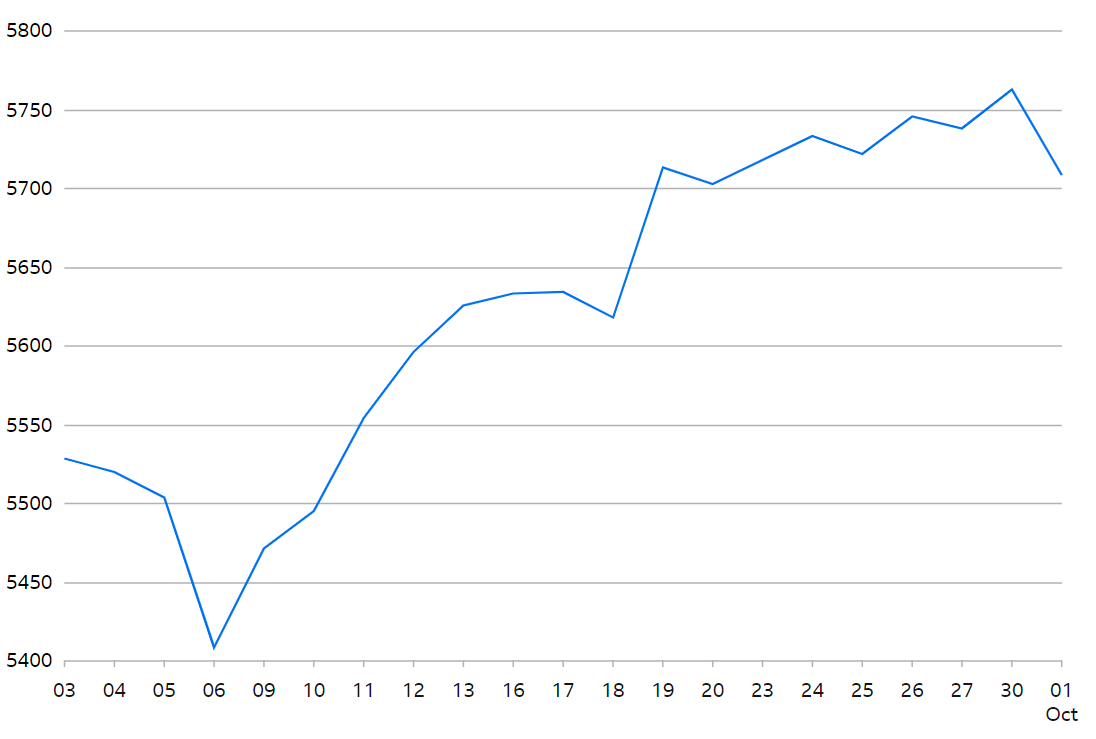

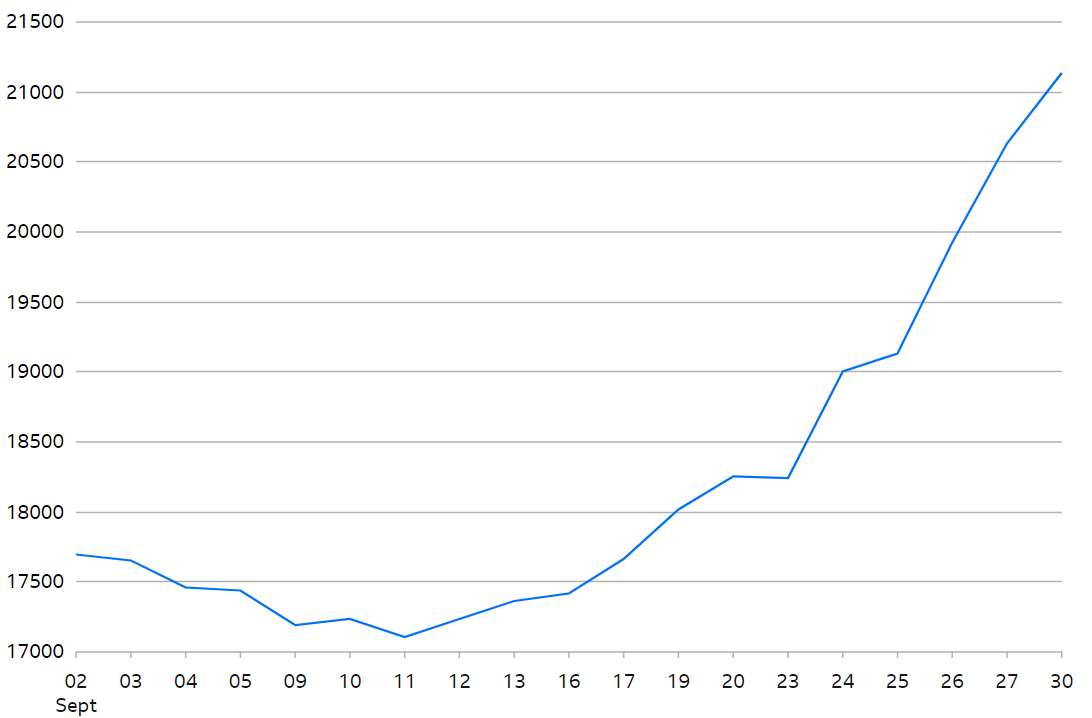

In North America, the S&P 500 Index rose by 2% in September. This brings the year-to-date performance close to +21%.

Source: BBC Market Data

Source: BBC Market Data

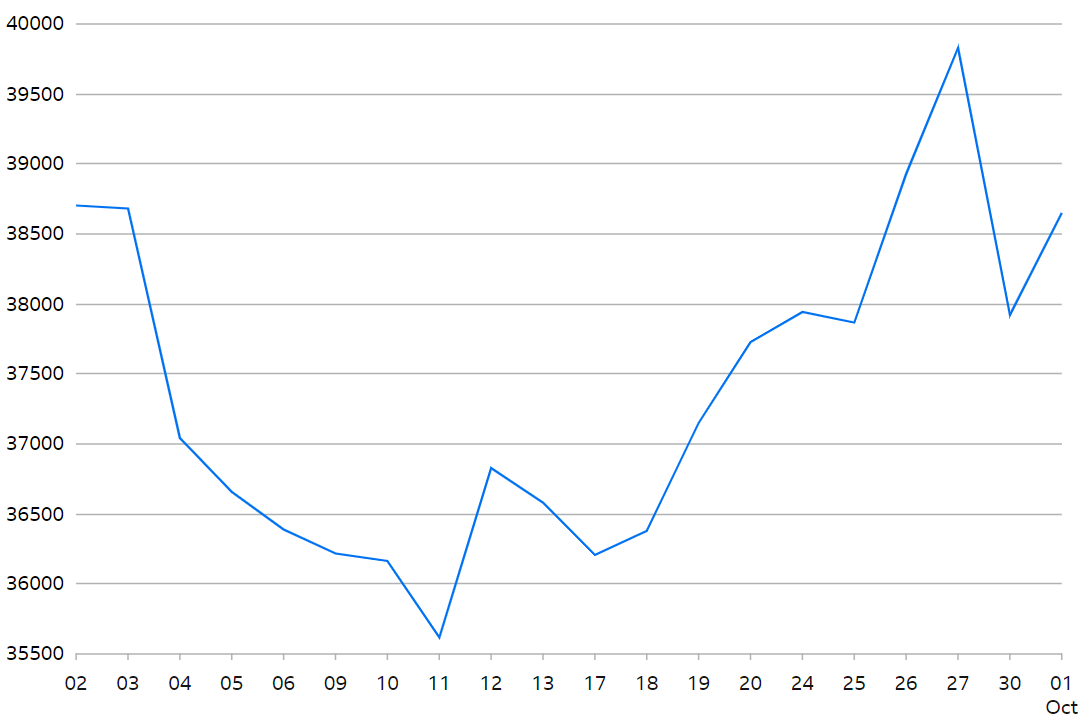

In Japan, the Nikkei 225 Index fell by almost -2% in September. This brings the year-to-date performance close to +13%.

Source: BBC Market Data

Source: BBC Market Data

In the Asia Pacific (excluding Japan), the Hang Seng Index rose by almost 18% in September. This brings the year-to-date performance close to +24%.

Source: BBC Market Data

Source: BBC Market Data

The US economy, interest rates and the impact on investments and pensions

Most UK pensions are directly linked to the US economy through investment in some of the biggest and most successful global companies. Those companies have traditionally been seen as a safe option for reliable returns. It means that any action those companies may decide to take, based on things like an interest rate cut, can impact the value of the holdings in your pension fund.

So why would the Federal Reserve cut interest rates? It’s a common move when central banks are worried about inflation or a slowing economy which can result in stock prices increasing. If your pension is invested in those stocks, you might see some gains. It can also lead to a chain reaction that influences interest rates, stock markets, and currencies in other countries too.

The effect on UK interest rates

The Bank of England could respond to the Federal Reserve by adjusting UK interest rates. Lower UK interest rates will positively impact pensions invested in longer dated bonds, as previously issued bonds become more financially attractive. However, for shorter dated bonds, for example those with less than five years to maturity, or savings accounts that rely on interest, the impact would be negative.

Currency

An interest rate cut in the US can also influence the value of the pound in the UK. If the dollar weakens because of the interest rate cut, it could make imports from the US cheaper, but it could also create instability in the currency markets.

Inflation

Over the long term, an interest rate cut can impact inflation. When interest rates are low for too long, inflation tends to rise, which can impact the value of your pension savings.

It’s highly unlikely your pension is solely invested in US companies. Most pensions are diversified, across a range of locations and asset types. This means your retirement savings could be invested in company shares, bonds, cash, property and other assets, across the globe, depending on the plan you’ve chosen. As a result, a decline in one type of asset or location can be offset by growth in the others. The aim of diversification is achieving not only balance, but ultimately growth over the long term.

While the cut to US interest rates might have some short-term effects, it’s important to remember that your pension is a long-term investment. Historically, the stock markets balance out over time but this isn’t guaranteed. It’s wise to be aware of how global economic changes can trickle down and impact your pension but it’s important to try not to fixate on short-term balance fluctuations.

This is part of our monthly pension update series. Check out the next month’s summary here: What happened to pensions in October 2024?

Have a question? Get in touch!

Do you want to know more about your pension plan with PensionBee? You can check out our Plans page to learn how your money is invested in different assets and locations, or log in to your BeeHive to see your specific plan. You can always send comments and questions to our team via engagement@pensionbee.com.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.