This is part of our monthly pension update series. Catch up on last month’s summary here: What happened to pensions in January 2023?

In the UK, inflation levels (10%) are beginning to simmer down while interest rates (4%) are approaching their boiling point. The good news for savers is that both are expected to steadily decline over the course of 2023. There’s bad news for those craving salads this Spring, as many British supermarkets are limiting the sale of certain fruit and vegetables. Why? The BBC reported that bad weather conditions in growing regions of Spain and Morocco are to blame for the food shortages. Another blow to shoppers filling up their baskets in the cost of living crisis.

Meanwhile, the potential of a US recession’s on a knife’s-edge. As the Federal Reserve raises interest rates (4.50% to 4.75%) to balance inflation levels (6.4%), companies are finding their profits squeezed. The success of US stocks in January may’ve only been a flash in the pan, as February saw investor appetite dwindle. Between higher energy prices and lower consumer spending, the food industry’s one example of underperformance, with shares in companies like Domino’s Pizza (-9.6%) and Starbucks Corp (-2.9%) falling in February.

In a nutshell, the shifting fortunes of various industries and regions is another reminder to not keep all your eggs in one basket and ensure your investments are diversified. If you’re a PensionBee customer, you can read our Top 10 holdings in your pension blog to discover the companies your plan’s invested in, or visit our Plans page to see what investment types and locations your pension’s spread across. You can always send your investment comments and questions to our team via engagement@pensionbee.com.

Keep reading to find out how markets have performed this month, and if the FTSE 100’s at an all-time high, why isn’t my pension?

What happened to stock markets?

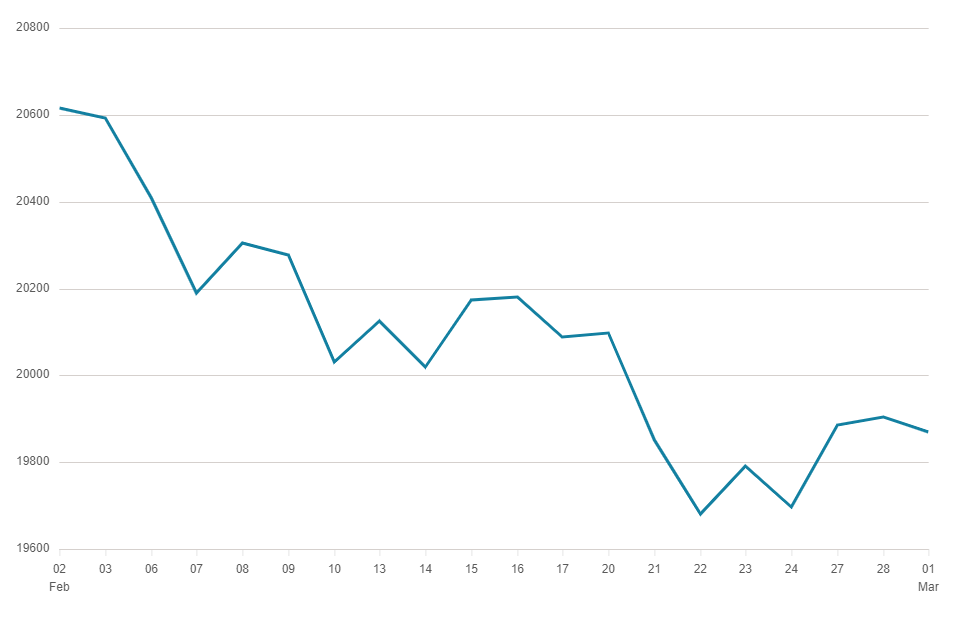

In UK stock markets, the FTSE 250 Index fell by almost 4% in February, bringing the year-to-date performance close to 4%.

Source: BBC Market Data

Source: BBC Market Data

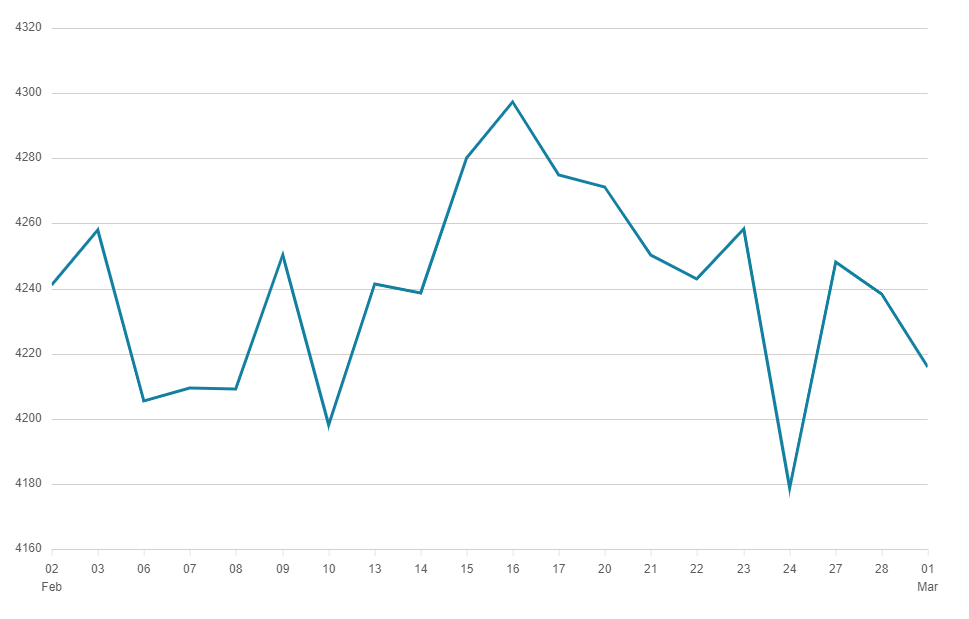

In European stock markets, the EuroStoxx 50 Index fell by almost 1% in February, bringing the year-to-date performance close to 9%.

Source: BBC Market Data

Source: BBC Market Data

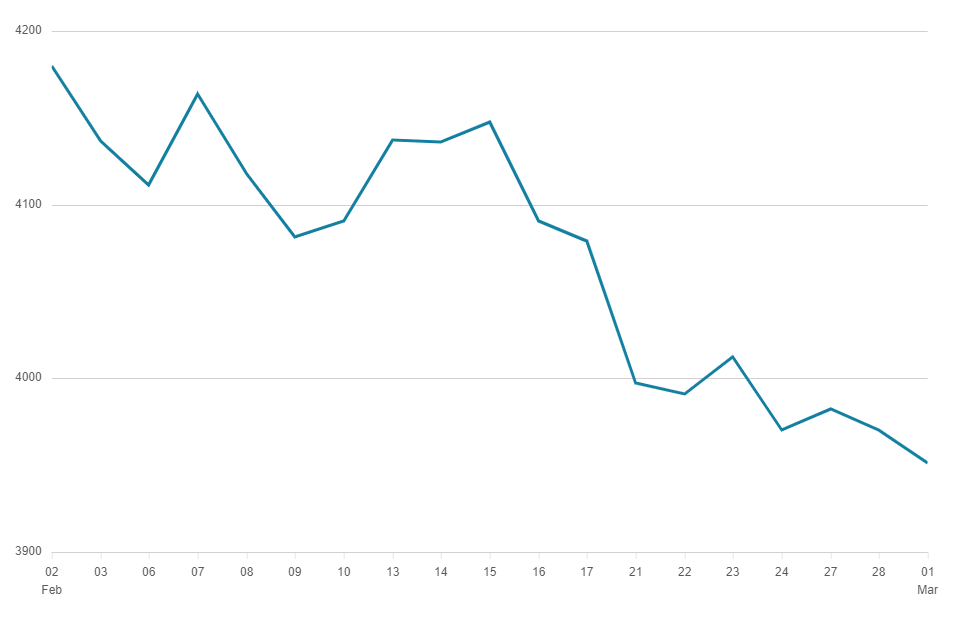

In US stock markets, the S&P 500 Index fell by over 5% in February, bringing the year-to-date performance close to 3%.

Source: BBC Market Data

Source: BBC Market Data

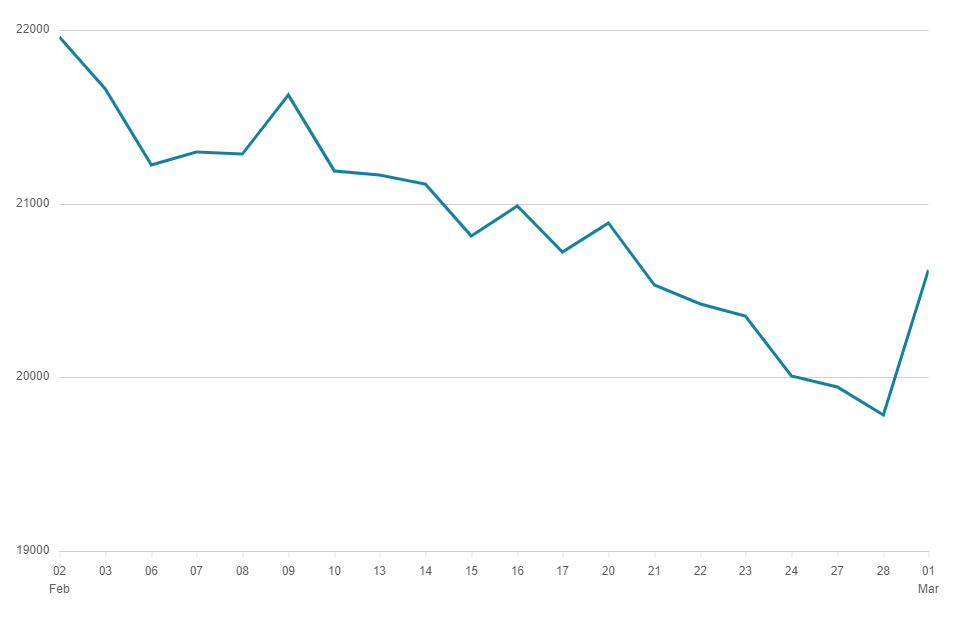

In Asian stock markets, the Hang Seng Index fell by almost 6% in February, bringing the year-to-date performance close to 1%.

Source: BBC Market Data

Source: BBC Market Data

If the FTSE 100’s at an all-time high, why isn’t that reflected in my pension balance?

The FTSE 100’s a stock market index that tracks the performance of the top 100 companies listed on the London Stock Exchange by market capitalisation, or size. It’s widely used as a thermometer for the UK economy and is one of the most widely followed indices in the world. Some of the volume leaders in the FTSE 100 include: BP, Legal & General, Tesco, and Vodafone.

In 1990, almost a third of UK pensions were invested in UK company shares. However, over the past three decades UK companies have fallen out of favour, with a 90% decline in their weighting in many UK pensions. Money managers have slowly moved away from UK investments as other countries present more growth opportunities for UK investors.

The reason your pension’s unlikely to mirror the movements of the FTSE 100 is because your exposure to those companies is minimal. In fact, even the success of the FTSE 100 can be driven by a few large companies and not reflect a regional trend. So why has the FTSE 100 risen this year? And how does the FTSE 100 compare to the S&P 500 over time?

What’s caused the FTSE 100 to rise?

The beginning of February witnessed the FTSE 100 reach a record high. Companies such as BP (14%), Vodafone (16%), and most notably Rolls-Royce (41%), were among the big winners of early 2023 contributing to this rise. While these FTSE 100 companies are listed on the London Stock Exchange, they often have international operations.

Many UK company shares with overseas trade have benefited from a weaker pound this year. The value of exports from the UK has increased due to the weak pound, making it more affordable for foreign buyers and boosting the volume of business done abroad. The more UK-based index, the FTSE 250, has yet to see the high returns of the FTSE 100.

What stock market index is my pension primarily invested in?

It may surprise you to know that UK pensions are more likely to be heavily invested in US companies than UK ones. This is because one of the core objectives of a money manager’s to maximise investment returns, and pension funds will invest in markets that help them achieve that objective. How does the US stock market index, the S&P 500, compare to the FTSE 100?

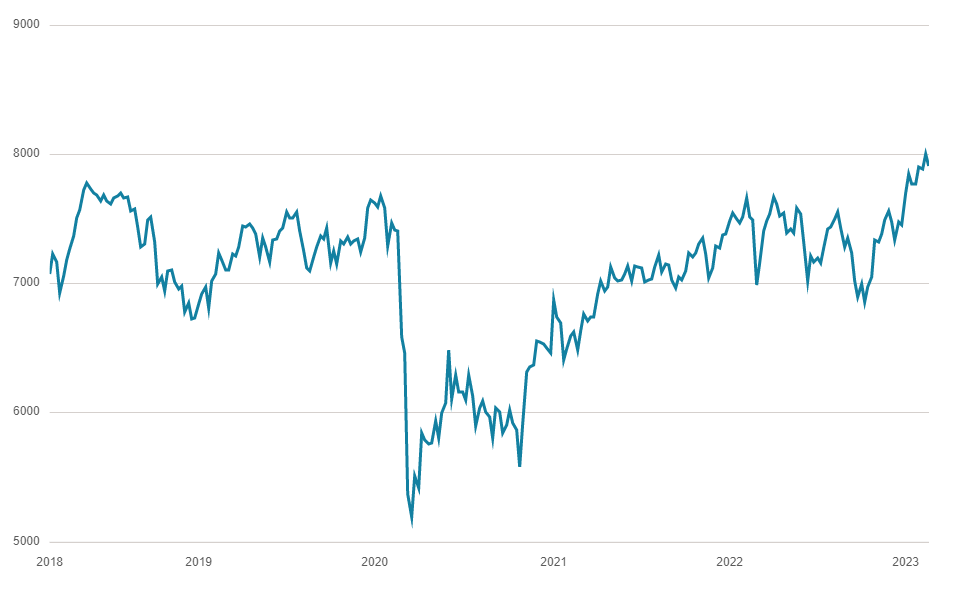

Over the past five years, the FTSE 100 Index has grown over 12%, bringing the annualised performance close to 2%.

Source: BBC Market Data

Source: BBC Market Data

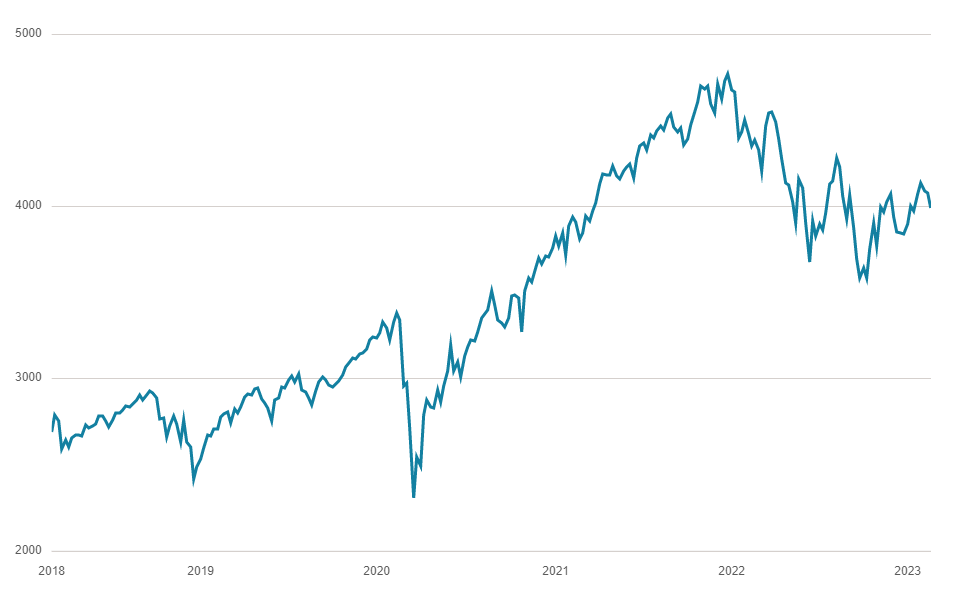

Over the past five years, the S&P 500 Index has grown over 49%, bringing the annualised performance close to 10%.

Source: BBC Market Data

Source: BBC Market Data

Remember, pensions are a long-term investment. As you can see the S&P 500 has outperformed the FTSE 100 over the past five years. Investing your money across different stock market indices helps shield your savings from the full impact of turbulence of any one market, and gives them more opportunities to grow.

This is part of our monthly pension update series. Check out the next month’s summary here: What happened to pensions in March 2023?

Have a question? Get in touch!

You can check out our Plans page to learn how your money is invested in different assets and locations. You can always send comments and questions to our team via engagement@pensionbee.com.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.