The value of a currency’s often a sign of the health of a country’s economy. As currencies fluctuate in value they’re often phrased as being “strong” or “weak” compared to others. Exchange rates are those points of comparison, as you move money from one currency to the equivalent buying power in another.

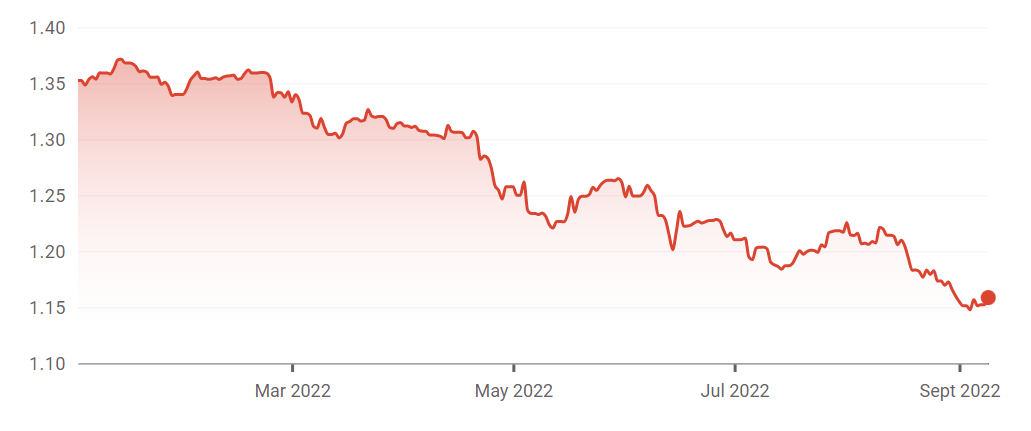

This year the pound has been gradually falling in value. All currencies fluctuate in value, often in reaction to economic outlooks or trade deals. However, comparing the Great British pound (GBP) to the US dollar (USD) there’s almost a 15% decline in 2022 alone. In recent weeks the pound has slid to its lowest level since 1985, even surpassing the fall from the coronavirus pandemic and Brexit vote. As of writing, £1 (GBP) is worth $1.15 (USD).

Source: Google, year to date comparison of GBP to USD.

Source: Google, year to date comparison of GBP to USD.

Why is this happening? Simply, the two currencies are moving in different directions. The strength of the US dollar is one part of this story. The US dollar is the major global “reserve currency”, meaning when times are tough investors flock to buy it as a store of value. While the Great British pound is also a highly respected currency, the UK’s undergoing major changes to its economic and political outlook, which are concerning to some overseas investors, leading them to invest less in the country.

These changes include the perceived impact of Brexit, political considerations over the future governing arrangements in Scotland and Northern Ireland, energy costs and the war in Ukraine – as well as risks of reduced consumer expenditure during the cost of living crisis. As this gap widens, those with pensions may find their balance impacted by this exchange rate, particularly if they hold US investments in their pensions.

Why’s my pension invested in US companies?

In the UK, FTSE 250 companies have offered little growth in recent years for investors. Across the Atlantic Ocean, the S&P 500 tells a different story. US company shares continued to rally against the odds, with most sectors advancing during the same period. The success of ‘big tech’ in the US has resulted in many pension plans featuring these companies in their top 10 holdings.

Customarily funds such as pensions will invest internationally as part of diversification, the approach of spreading your investment eggs in more than one basket. Chances are many UK investors also hold more of their retirement wealth in US companies than UK companies. This is because over the past five years, the US market has greatly outperformed the UK market. As of writing, the S&P 500 has reported a positive 62% return whereas the FTSE 250 has performed with a negative -0.8% return, during the same five year period.

The US is both geographically and economically larger than the UK. Also, many global, high performing technology companies were founded and financed in the US: Alphabet (previously known as Google), Amazon, Meta (previously known as Facebook), and Microsoft - to name a few. When comparing the value of companies, economists may refer to ‘market capitalisation’ which simply means their size, or share price multiplied by the number of shares. Below is a table of the 10 largest S&P 500 Index companies and their performance during the past five years.

| Ten largest US companies (by ‘market capitalisation’) | Performance over 5 years (%) |

|---|---|

| Apple | 286% |

| Microsoft | 243% |

| Alphabet | 131% |

| Amazon | 163% |

| Tesla | 1,042% |

| Berkshire Hathaway | 57% |

| Meta | -5.5% |

| Taiwan Semiconductor | 117% |

| UnitedHealth | 166% |

| Nvidia | 210% |

Source: Google; note past performance is not a guarantee of future returns

If my pension’s invested in US companies, how does that affect me in the UK?

Aside from the performance of the company shares your pension invests in abroad, you could be impacted by the currency of those investments too. If your pension’s invested in US stocks and the US dollar rises, holding all else equal, so will your returns. If the dollar falls, so will your pension balance.

Because these changes in exchange rates can cause undesirable volatility in pension investments, many fund managers will “hedge” or “cancel out” the effect of currency changes, especially if you’re closer to retirement.

Therefore, if you’re close to retirement or if your fund manager uses hedging as a way of reducing volatility, you’ll be protected from negative currency moves on your overseas investments (such as a weakening of the US dollar), but also won’t benefit from positive ones (such as a strengthening of the US dollar).

What are some of the other pension implications of a falling pound?

Those currently withdrawing an income from their pension may see a reduced purchasing power from the pound’s weaker economic position. The rate of inflation’s already hovering at a 40-year high, and a weak pound can increase inflation further because the cost to import goods increases.

The UK, in particular, is vulnerable to the volatility of exchange rates as it imports more than it exports. When these common imports into the UK (like stone, glass, and semi-precious metals) from the US increase in costs, goods in the UK become more expensive to buy. Retirees that are reliant on their fixed incomes (like annuities), will be hit the hardest as inflation erodes the buying power of their retirement income.

The current interest rate set by the Bank of England is 2.25%, following several incremental increases in an attempt to reduce inflation. The government will be creating economic policies to limit the impact of inflation, as much as possible. Energy bills have already been highlighted as a key area of concern by both parties in the House of Commons. For now retirees may feel pushed to withdraw more money to keep up with the rising costs in the UK.

Should I do something?

Aside from the pound falling, we’re still firmly in the grips of a bear market (a market downturn). The two are connected by a few factors (such as inflation and trade) but are distinct from each other. It just so happens that we’re in a period of history where currencies, economies, and stock markets are all struggling in their recovery from the global shocks of recent years.

Withdrawing your money won’t recover losses. Money invested may see recovering markets so, if you can, prioritise using rainy day funds before realising losses on your investments. Those are the key takeaways to navigating market volatility.

As strange as it may sound, contributing to your investments when markets are low can be cost-effective. Adding £100 when markets are down will usually buy you more units than when markets are up, when unit prices are more expensive.

Again, it’s worth remembering that it’s normal and expected for pensions to go up and down in value. And it’s expected that they’ll recover and grow further in the future. If you’re over the age of 50 and are considering your retirement options, you may benefit from a free Pension Wise appointment. You can book your appointment online.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.