This article was last updated on 20/07/2023

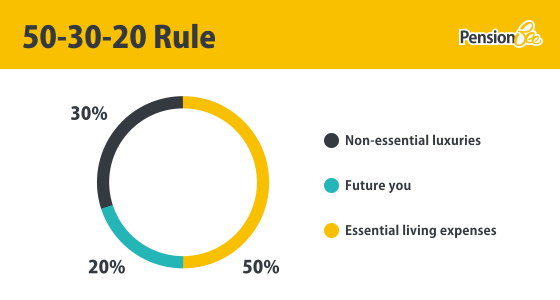

A good spending and savings plan helps you understand what income you have, what needs to be allocated to immediate living expenses and what you plan to do with the rest. The 50-30-20 framework has traditionally been a popular rule of thumb to follow for budgeting your outgoings and savings. The idea is that you split up your total income as follows:

- 50% on current ‘needs’ (essential living expenses): food, transport costs, mortgage/rent, utility bills, essential clothing costs, minimum repayments on debt balances.

- 30% on current ‘wants’ (non-essential luxuries): gym memberships, gadgets, eating out, hobbies, subscription services.

- 20% towards future savings and debt repayments: putting money aside for unexpected financial emergencies, saving for future goals, investments, pensions, debt overpayments.

As an example, for someone with £2,000 income after tax, they would broadly allocate:

- £1,000 towards ‘needs’

- £600 towards ‘wants’

- £400 towards savings or debt repayments.

But a rule of thumb is just that - a guide. If you looked at the outgoings of 100 people earning the same amount of money, none of them would split their outgoings in exactly the same way because everyone’s financial situation is different.

If your choices around where you spend and save your money don’t follow the 50-30-20 rule, that’s fine as long as you have a healthy balance across current and future spending and saving. Personal finance is personal after all. However, if you want to increase your savings or pay down debt balances, the framework provides a good reference point to keep in check your spending on those things which are not necessities, and make sure you keep half an eye on the future.

Spending on ‘needs’

Our ‘needs’ are costs we have to incur in order to survive and so they’re a constant feature in our budget; you need somewhere to live, clothes to wear, and adequate food and water to stay in good health. These things are non-negotiable. So the starting point for budgeting our money begins with looking at how much money we need to allocate to those essential living costs. The issue is that over the last few months, almost all of our essential living costs have seen significant price increases, and some are still going up.

- The cost of our grocery shopping has been rising steadily over the past few months, as a result of legacy issues from factory shutdowns during the pandemic, the Russia-Ukraine conflict and increased energy costs for the food and beverage sector.

- Similarly, the amount we’re paying to fill our cars at the petrol station or charge them at electric charging points has increased substantially over the past year.

- The new Energy Price Guarantee came into force on 1 October 2022 and although it has alleviated the threat of further energy prices rising over the next two years, bills for the typical household are still more than double what they were this time a year ago.

- In an attempt to curb inflation, the Bank of England has hiked rates several times since December 2021, when the cost of borrowing was 0.10%, to its current level of 5%. Banks have since passed this increase through to mortgage holders. This impacts both homeowners on variable mortgage rates or needing to refinance, and landlords who will undoubtedly pass the cost on to tenants through increased rent.

- Credit cards with rates linked to the base rate will cost consumers more in increased borrowing costs.

So in light of this, does the 50-30-20 rule of thumb still apply in the current economic climate? If not, what needs to change?

What needs to change in the face of the cost of living crisis?

For many people, their spending on essential living costs is now considerably more than 50% of their income after tax. You can’t simply sacrifice spending on your ‘needs’ - these are things you can’t live without, or at least not without a significant decline in your standard of living. But you can make sure that you’re optimising what you do spend on these items.

Firstly, it’s crucial to make sure that you’re not overpaying for those items that you need to live comfortably. Compare your current deal to the best deals on the market for all your essential bills. This might result in you switching your mortgage provider or utility supplier to get the best deal available based on your circumstances. When it comes to groceries, it may mean changing where you shop, meal planning to avoid wastage and buying in bulk to make sure you’re getting the most for your money. It can be time consuming but it’s time well spent.

Once you have clarity on the lowest level your essential spending can go to, then you can work out how much of your income is left to split between the other two options; ‘wants’ and savings.

Take a good hard look at your everyday spending; grab a highlighter and highlight on a printed bank statement all of those things which you spend money on that aren’t needed to keep you fed, clothed or housed. It’s often shocking to see on paper how many ‘wants’ creep into our lifestyle. Then ask yourself what can you do without? This is the brutal reality of creating an effective spending and saving plan for your monthly income which doesn’t involve you needing to rely on credit each month. Sacrifices may be required.

Do you need to press pause on subscriptions for a period of time? Are there things you haven’t used enough to justify spending money on each month? Can you do without certain things in the short-term and instead defer the spending into the future? Remember these changes don’t have to be forever, just until you have more disposable income to add back in the money for spending on luxuries.

The danger comes if you don’t make sacrifices around your luxury spending, but instead opt to reduce your outgoings towards future savings and debt. If you lower the amount you put away each month towards savings and debt repayments, you’ll be doing a huge disservice to ‘future you’. It’s important that you don’t lose sight of the value of making sure you’re doing the right thing with your finances both now and for the future. We’ll come out the other side of the cost of living crisis and your future self will thank you for not making sacrifices now which will make life all the harder for you in the future.

Make sure you’ve weighed up the consequences of any actions which impact your future finances:

- Canceling standing orders into savings accounts for the things that are important to you in the future. This may seem an easy option to free up cash for the things you ‘need’ and ‘want’ today, but it means you’re likely going to miss out on those financial goals you have beyond the immediate future. Ask yourself how much those goals mean to you on a scale of one to 10 and ask yourself the same about the alternative choice for spending that money now. Give yourself the opportunity to reflect on the longer term consequences of your current actions.

- Reverting back to paying only the minimum balances on credit cards or loans. Paying off debt, whilst it’s hard, has benefits in so many areas; your mental health, your credit score and your financial resilience to withstand future financial knocks. If you revert back to minimum payments, you’ll end up paying more in interest payments over the lifetime of your debt. Ultimately this means less money to spend on the things you enjoy in life, now and in the future.

- Canceling payments towards investments. You’ll miss out on the benefit of compound interest increasing the value of those investments over time. Money loves the power of time to grow; compound interest is where your money and the interest it earns continues to grow over time as a result of interest being earned on the interest as well as the initial deposit or investment. It’s always possible to restart payments again in the future, but it will require larger deposits to get the same financial outcome in the future if you stop for a period of time. Be aware that your actions now can be costly in the future.

- Dialing back pension contributions, or stopping them altogether, because you feel as if retirement is a long time away and there’s plenty of time to catch up later. Not only do pensions grow with the power of compound interest but your pension contributions are topped up by tax relief from the government. If you’re a basic rate taxpayer you’ll usually get 20% tax relief. In practice this means if you wanted to add £100 into your pension you’d only need to pay in £80 and HMRC will add the rest. Reducing or stopping pension contributions is essentially saying ‘no thank you’ to this free money. At a time when everything is getting more expensive, free money is a wonderful gift. Remember, too, that in order to have enough money saved for a comfortable retirement, it is advisable to aim to save 15% of your salary into retirement savings throughout your working life.

- Don’t make the mistake of using your emergency savings for anything other than emergencies. Keep a stash of cash available for those things that you haven’t planned for in your budget and which have the potential to really knock you financially. If something unexpected happens and you don’t have a cushion to fall back on, you may need to resort to credit cards or loans which will ultimately cost you a lot more over the longer-term.

The ‘new’ rule of thumb

There is no one-size-fits-all rule when it comes to effective money management because it needs to be right for your circumstances and your life goals. However, aiming to allocate 20% of your income towards saving or paying off debt remains a good aspiration, regardless. How the remainder is split between ‘wants’ and ‘needs’ will be unique to your circumstances. Your allocations may look like 65-15-20 or they may look like 80-0-20. Whatever it is, remember that good money management starts with getting clarity around where you’re currently spending and saving and, from here, you can make better decisions.

The 50-30-20 rule does need to be adapted to reflect the changing economic climate. With the cost of essential living expenses rising, the key to being financially secure starts with being able to optimise your spending on needs and get visibility on how much this leaves for everything else, then reigning in how much you spend on ‘wants’ so you can be disciplined to continue saving for the future and paying off debt.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

Emma Maslin is a certified Financial Coach and Mentor, Financial Wellness Speaker and Founder of multi award-winning personal finance education website The Money Whisperer. A former Chartered Accountant, Emma believes financial health and wellbeing isn’t a luxury just for the wealthy; it’s a basic need for all of us.