Investments have dropped in 2022. A cost of living crisis in the UK, an ongoing war in Ukraine, international supply chain issues due to shutdowns in China, on top of rising interest rate expectations, have created the perfect storm for market volatility. And your pension, like all investments, has not escaped these global shocks and will likely have experienced some extreme knocks. Taking all these elements into consideration, we examine what’s been happening to UK pensions as global investment markets plummet.

A rocky start to the year

The current economic downturn began in January this year, when both the FTSE 250 in the UK and the S&P 500 in the US fell by around 9%, sparking global concerns over investments. February saw many global stock markets continue to fall as more investments were shifted into traditionally more stable assets such as gold and government bonds. At last stock markets appeared to stabilise in March, with growth in some sectors giving rise to some cautious optimism about how the rest of the year might progress. This hope was quickly extinguished as poor market performance resumed in April. The FTSE 250 fell by over 3% and the S&P 500 fell by over 8%. These drastic declines in markets signalled that the volatility we had seen at the beginning of this year would likely persist for some time. Economic forecasts for the next six to 12 months appear dreary. At time of writing, the S&P 500 is down almost 17% year-to-date.

It’s important to understand that it’s normal for the value of your pension to go up and down over time, and that periods of extreme volatility are common over history, as witnessed in 1987, 1999, 2008 and 2020. Despite this, over the past five years the S&P 500 has seen growth of approximately 68%. At PensionBee most of our plans are diversified, meaning they’re invested across different countries and/or asset types (such as company shares, property and bonds). But when global markets are down across the world, pension balances will be impacted.

The impact on pensions in the UK

Across the UK, pension balances are volatile and many have experienced substantial falls over the last few months. Many savers nearing retirement will have been impacted by falling share and bond prices. We’ve selected a range of at or nearing retirement plans from a few different providers, to compare the performance of similar plans across the market. As you can see all plans have been negatively impacted by recent market conditions.

Performance of PensionBee’s 4Plus Plan over the past six months:

Source: Morningstar

Source: Morningstar

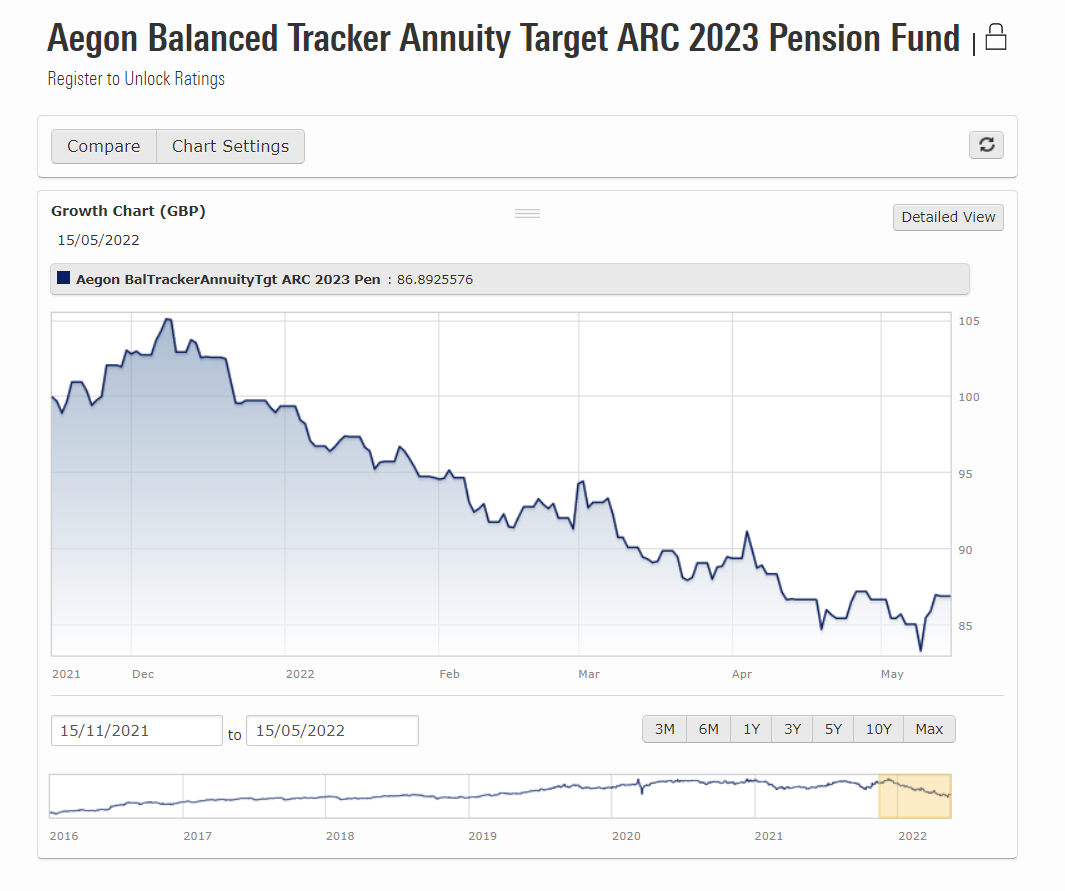

Performance of Aegon’s Balanced Tracker Annuity Target ARC 2023 Pension Fund over the past six months:

Source: Morningstar

Source: Morningstar

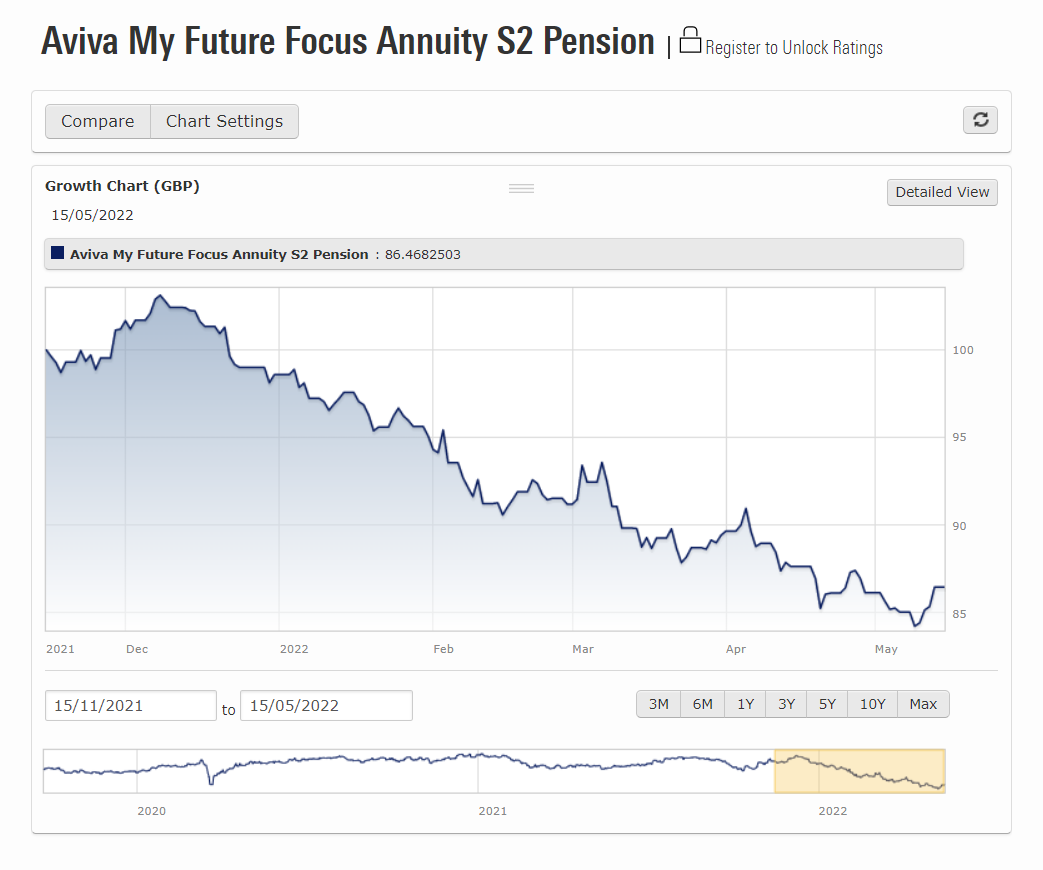

Performance of Aviva’s My Future Focus Annuity S2 Pension over the past six months:

Source: Morningstar

Source: Morningstar

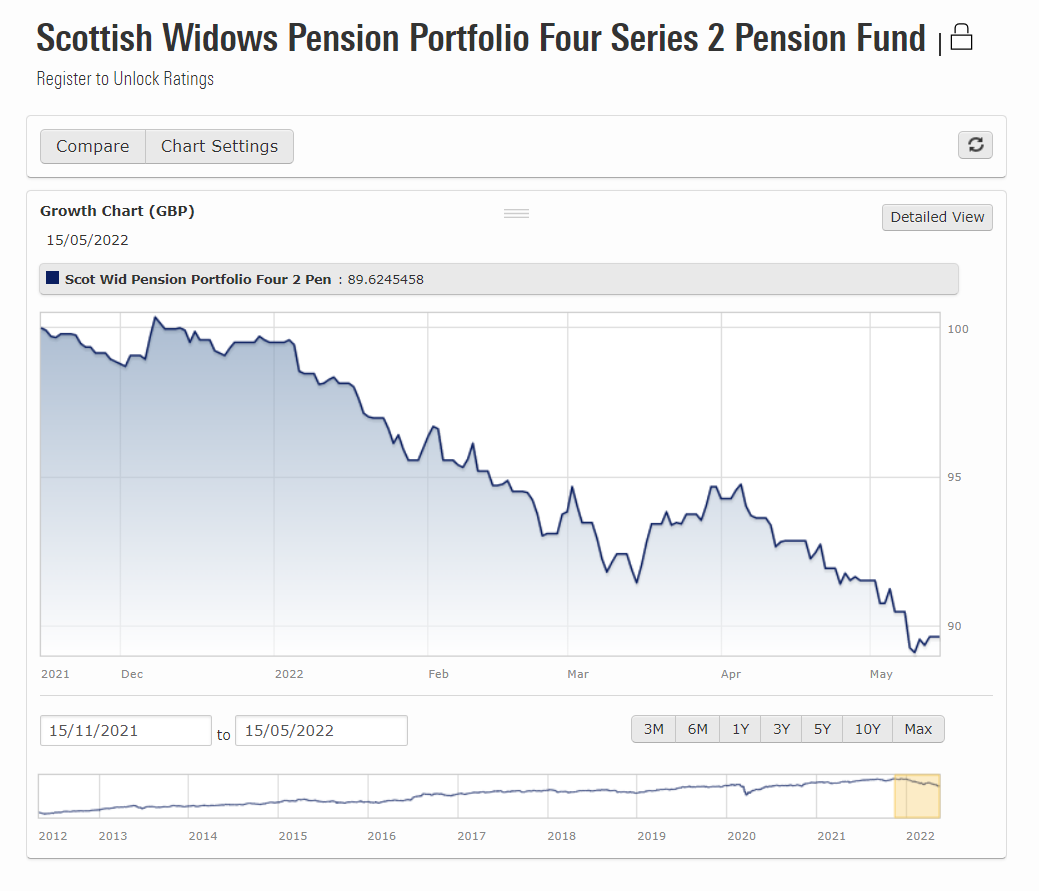

Performance of Scottish Widows’ Pension Portfolio Four Series 2 Pension Fund over the past six months:

Source: Morningstar

Source: Morningstar

Performance of PensionBee’s Tailored plan (Vintage 2025-27) over the past six months:

Source: Morningstar

Source: Morningstar

How to approach pension saving in times of market volatility

It’s hard to know in times like this if you’re making smart choices with your money. When problems arise it’s a natural instinct to want to take action to prevent further damage or loss. You may find yourself rethinking your pension savings during the cost of living crisis, or worrying about whether you’re making the right choices during the market volatility we’re facing.

But when investments are struggling to grow against the backdrop of persistent market losses, what can you do? The Financial Conduct Authority (FCA) is the regulator for over 50,000 financial services firms and financial markets in the UK. In their own market volatility messaging, they outlined three important considerations for when you’re making decisions about what to do with your investments:

1. Withdrawing your money won’t recover losses

When markets are considerably down many people are tempted to withdraw from their investments under the assumption their money is safer in their pockets than in stock markets. Or even move their pension because they believe their provider is to blame for the losses caused by market volatility. However, withdrawing your money won’t recover losses, in fact all withdrawing does is guarantee your investment loss.

2. Money invested may see recovering markets

It’s easy to forget right now that investments go up, as well as down. So the more you withdraw, the less you’ll have invested to recover when markets rise in value. Withdrawing during a downturn guarantees a loss, whereas waiting for markets to bounce back gives you an opportunity to regain and grow your investments again.

3. Access your rainy day savings before realising losses

Finally, if you’re in need of money in the short to medium term then consider withdrawing from cash savings before accessing your investments (like pensions). Having a rainy day fund is really valuable as it’s better to spend from cash savings than realising losses on your investments.

What if you have further questions about your pension?

We understand that you may have concerns about your pension during times of economic uncertainty. So we’re here to help and answer any questions you might have.

You can contact your BeeKeeper either by:

- Emailing them (find their details in your BeeHive)

- Calling 020 3457 8444 (Mon-Fri 9:30am-5pm)

You can also contact our dedicated engagement team on engagement@pensionbee.com.

If you are over the age of 50, you may also benefit from a free Pension Wise appointment. You can book your appointment here.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.